Saturday, 29 October 2011

Gino Venitucci knows how to make money in growing olive trees

The color is not the only green in olives. People make money growing olive trees.

Gino Venitucci is growing about 16,000 3-year-old olive trees on his farm near Devers. Next year, a commercially viable harvest will be in the offing in this alternative oil industry.

Reading from documents delineating the potential payoffs, Venitucci explained how profitable, per acre, olive tree growing could be, if the farmer lasts through the growing pains. He was not talking about the prospects in the rich soil of his native Italy.

“During the fourth year, in other words the fourth year after planting, the minimum one could obtain is $4,000 an acre — weather going bad, like this year, no rain, irrigation, missing fertilizing, or everything going wrong at one time,” Venitucci said, addressing the Oct. 26 Liberty-Dayton Area Chamber of Commerce Luncheon. “However, you could increase it to $6,000 the fourth year. Now as you go to the fifth and sixth years, you can go to $9,600 per acre, if all this is correct.

“A hundred acres, which is a relatively small amount for Southeast Texas, would be $960,000 for three months work. It wouldn’t be bad.”

The farmer is optimistic about his orchard’s potential.

“Next year, we definitely expect a large production,” Venitucci said, a few small bottles of home-grown olive oil lined up on the head table beside him.

Those bottled giveaways and assorted documents were gone within 5 minutes of the luncheon’s conclusion. The investment possibilities grabbed guests’ attention.

One could earn a bachelor’s degree in the time it takes to reach the first yield. The income may flow for generations thereafter.

Anyone preparing to grow olives for profit might brace for the investment per acre, as Venitucci explained.

“I would go with a minimum of $10,000 per acre over the four-year period because of the plants, the planting, the irrigation, the water wells or whatever you needed, and the machinery, and the diesel, and the labor,” Venitucci said. “The first four years are labor intensive.”

The income should outlast the farmer.

“If one estimates that 100 acres would cost $1 million … but you would get it back in the fourth year of production or fifth year of production,” Venitucci said. “Then, for generations, you wouldn’t have to worry about it. Accept that income every year. It’s justifiable.”

If the olive oil industry means anything to some Texas farmers, it is a source of hope amid hard times that transcend the region’s drought.

“I was an ag lender for most of my life, in a bank, and I am fond of agriculture,” Venitucci’s friend Bob Jamison said, following the luncheon. “I am aware of their plight, with the falling prices, increase in labor, and the embargo against exports. Everything that could happen to a farmer has happened.

“But this is an occasion where they can make several thousand dollars off of only one acre. Where a rice farmer has to have 300 to 500 acres, to break even, these people can do it in a home farm, like 50 acres or less.”

Olive oil’s expansive culinary utility potentially sweetens the deal for growers, Jamison said.

“It is a good thing for agriculture; it is a great thing for the product that is so helpful,” Jamison said. “Every medical facility will tout the benefit of olive oil.”

Labels:

Affliate Marketing

Birmingham riots: Police authority calls for insurance law change

Police authority leaders have called for a change in insurance law after they faced claims of £5m for damage caused in August's Birmingham riots.

West Midlands Police Authority said that under the 1886 Riot Damages Act, it was liable to pay for damage to buildings and their contents in a riot.The authority then bids for money to be paid back to it by the Home Office.

Police authority chairman Derek Webley said they were costs "that should be borne by insurance companies".

He added: "The Act needs to be repealed and we'll be working with MPs within our locality to see if we can try to address this issue."

James Morris, the Conservative MP for Halesowen and Rowley Regis, said he agreed with Mr Webley.

Mr Morris said: "We don't want to be in a position, if it can be avoided, where the police authority has to tap into its reserves to compensate these businesses.

'No guarantee' "We need to make sure that [the authority] makes that grant application and that we keep pressure on the Home Office."

A report to a meeting of the police authority on Thursday warned there was "no guarantee that the cost of these claims will be reimbursed".

Any costs not covered by a Home Office grant will have to be paid out of the authority's budget for this year.

Many insurance companies do not have to pay out because of clauses saying that damage to shops and homes caused by riots is not covered.

The Home Office said people affected by the riots were able to claim from their insurance company and the firms could then claim from the police authority, which would assess those claims.

The report also states that claims of more than £2.5m for the cost of "business interruption" during the riots will not be paid.External loss adjusters are being brought in by the police authority at an estimated cost of £50,000 to advise on higher value or more complex cases.

It said it had also set up a special panel to make decisions on payments "as quickly as possible".

Source www.bbc.co.uk/

Labels:

Affliate Marketing

Occupiers make themselves at home in downtown

By Gerrit De Vynck

Multi-coloured tents are filling downtown Ottawa's Confederation Park as demonstrators join with the international Occupy Wall Street movement to protest what they see as injustices across a broad spectrum of issues, from the economy to the environment to indigenous rights.

The movement came to Ottawa on Oct. 15 when more than 500 people gathered at the park at Laurier and Elgin streets to hold a public meeting and decide by consensus what site they would occupy.

"We are here to occupy Ottawa," Brigette DePape told the crowd of mostly young people dotted with families and seniors.

"This is what democracy looks like," said the 22-year-old activist and former parliamentary page who lost her job after holding up a sign reading "Stop Harper" during last June's Throne Speech.

The movement began with a call to "occupy Wall Street" by Vancouver-based anti-consumerism magazine Adbusters.

On Sept. 17 protesters in New York City took up the call and marched through Wall Street denouncing the global financial system they accuse of concentrating money and power in the hands of a few while marginalizing the vast majority of citizens.

Since then, occupations have sprung up in hundreds of cities all over the world.

"I feel there is a bit of history-making going on," says Ria Heynen, a retiree who was protesting at the Ottawa rally.

Another protester, Mike Abraham, says he wants to raise awareness about the shrinking middle class. "My concern is that . . . the main message might end up being co-opted by somebody's more fringe messages."

Members of the Air Canada flight attendants' union were at the rally protesting the government legislating them back to work. Another man held high a photo of Moammar Gadhafi.

It's important to know everyone at the protest is representing only themselves, says Alex Hill, a student at the University of Ottawa and a member of Occupy Ottawa's legal committee. "Everybody here is coming with their own pet issues," he says.

But this diversity gives the movement legitimacy, argues Hill. "There's been some discussion about whether or not the group has a coherent message yet," he says, "But I think it's precisely because it's such a grassroots process that these things take time."

That lack of a single message has been the reason behind the bulk of the criticism against the movement.

"We don't have one coherent message, we have many coherent messages," says Arun Smith, a student at Carleton university, who also works for the government.

The general assembly began at noon. After discussing several proposals, the group decided to stay in Confederation Park instead of moving to Parliament Hill or Major's Hill Park near the U.S. embassy.

Confederation Park is owned by the National Capital Commission. The commission will let the police take the lead on whether or not to kick the protesters out of the park, says Jean Wolff, a spokesperson for the NCC.

But it's not up to the police to decide to remove the protesters because the land is owned by the NCC, says Ottawa police Staff Sgt. Dave Thomas.

The police haven't received any complaints about the protesters, says Thomas. Interactions between police and protesters have been good and they will only step in if any criminal activity happens, he says.

It's good to see people getting involved and exercising their right to protest, says Jordan Charbonneau, vice-president of the Centretown Citizens Community Association.

"A lot of Centretown residents share the concerns that the protesters are voicing. I'm sure many Centretown residents are taking part in the protests," says Charbonneau.

If the movement continues to grow the protesters might disrupt life in Centretown, says Charbonneau. But the police are doing a good job and protesters know they aren't there to damage anything or disrupt people's lives, he adds.

A week after the rally, the camp had grown to 50 tents. There was a kitchen, a media tent, a warming hut and four portable washrooms.

"This movement is open to all," says DePape. "We hope that everyone who walks by will join,” she says. "We're all part of this together."

Multi-coloured tents are filling downtown Ottawa's Confederation Park as demonstrators join with the international Occupy Wall Street movement to protest what they see as injustices across a broad spectrum of issues, from the economy to the environment to indigenous rights.

The movement came to Ottawa on Oct. 15 when more than 500 people gathered at the park at Laurier and Elgin streets to hold a public meeting and decide by consensus what site they would occupy.

"We are here to occupy Ottawa," Brigette DePape told the crowd of mostly young people dotted with families and seniors.

"This is what democracy looks like," said the 22-year-old activist and former parliamentary page who lost her job after holding up a sign reading "Stop Harper" during last June's Throne Speech.

The movement began with a call to "occupy Wall Street" by Vancouver-based anti-consumerism magazine Adbusters.

On Sept. 17 protesters in New York City took up the call and marched through Wall Street denouncing the global financial system they accuse of concentrating money and power in the hands of a few while marginalizing the vast majority of citizens.

Since then, occupations have sprung up in hundreds of cities all over the world.

"I feel there is a bit of history-making going on," says Ria Heynen, a retiree who was protesting at the Ottawa rally.

Another protester, Mike Abraham, says he wants to raise awareness about the shrinking middle class. "My concern is that . . . the main message might end up being co-opted by somebody's more fringe messages."

Members of the Air Canada flight attendants' union were at the rally protesting the government legislating them back to work. Another man held high a photo of Moammar Gadhafi.

It's important to know everyone at the protest is representing only themselves, says Alex Hill, a student at the University of Ottawa and a member of Occupy Ottawa's legal committee. "Everybody here is coming with their own pet issues," he says.

But this diversity gives the movement legitimacy, argues Hill. "There's been some discussion about whether or not the group has a coherent message yet," he says, "But I think it's precisely because it's such a grassroots process that these things take time."

That lack of a single message has been the reason behind the bulk of the criticism against the movement.

"We don't have one coherent message, we have many coherent messages," says Arun Smith, a student at Carleton university, who also works for the government.

The general assembly began at noon. After discussing several proposals, the group decided to stay in Confederation Park instead of moving to Parliament Hill or Major's Hill Park near the U.S. embassy.

Confederation Park is owned by the National Capital Commission. The commission will let the police take the lead on whether or not to kick the protesters out of the park, says Jean Wolff, a spokesperson for the NCC.

But it's not up to the police to decide to remove the protesters because the land is owned by the NCC, says Ottawa police Staff Sgt. Dave Thomas.

The police haven't received any complaints about the protesters, says Thomas. Interactions between police and protesters have been good and they will only step in if any criminal activity happens, he says.

It's good to see people getting involved and exercising their right to protest, says Jordan Charbonneau, vice-president of the Centretown Citizens Community Association.

"A lot of Centretown residents share the concerns that the protesters are voicing. I'm sure many Centretown residents are taking part in the protests," says Charbonneau.

If the movement continues to grow the protesters might disrupt life in Centretown, says Charbonneau. But the police are doing a good job and protesters know they aren't there to damage anything or disrupt people's lives, he adds.

A week after the rally, the camp had grown to 50 tents. There was a kitchen, a media tent, a warming hut and four portable washrooms.

"This movement is open to all," says DePape. "We hope that everyone who walks by will join,” she says. "We're all part of this together."

Labels:

Affliate Marketing

Smyrna's Unemployment Rate Dips; Home Depot Sending Jobs Overseas

By Hunt Archbold

The Jonquil City's unemployment rate is still higher than the national and state averages according to data released by the Georgia Department of Labor.

Smyrna’s unemployment rate was down to 10.9 percent in September from 11.1 percent in August. That’s still higher than the state’s rate of 10.3 percent and the U.S. unemployment rate of 9.1 percent last month.

Around 160 citizens found employment in Smyrna, in September, according to data released by the Georgia Department of Labor.

The City has a labor force of 28,253 people. Estimates show 25,185 people are employed.

Meanwhile from Vinings, WSB-TV is reporting that The Home Depot is shifting white collar jobs from its 2455 Paces Ferry Road headquarters to India. The company has reportedly laid off hundreds of its Vinings-based work force, while at the same time hiring hundreds of workers offshore.

The news station revealed that in the last decade, according to national labor statistics, U.S. companies have eliminated 2.9 million jobs at home, while also creating 2.4 million jobs overseas.

Around 160 citizens found employment in Smyrna, in September, according to data released by the Georgia Department of Labor.

The City has a labor force of 28,253 people. Estimates show 25,185 people are employed.

Meanwhile from Vinings, WSB-TV is reporting that The Home Depot is shifting white collar jobs from its 2455 Paces Ferry Road headquarters to India. The company has reportedly laid off hundreds of its Vinings-based work force, while at the same time hiring hundreds of workers offshore.

The news station revealed that in the last decade, according to national labor statistics, U.S. companies have eliminated 2.9 million jobs at home, while also creating 2.4 million jobs overseas.

Labels:

Affliate Marketing

I didn’t understand the Home Buyers’ Plan. What now?

I contributed $25,000 to my registered retirement savings plan for the sole purpose of withdrawing the funds under the Home Buyers’ Plan to buy a condo. Later I learned there is a 90-day waiting period for withdrawals. Does that mean I will not be able to use the money for my down payment? Is there any way I can access these RRSP funds?

The Home Buyers Plan is a great tool for first-time home buyers. It allows you to withdraw up to $25,000 tax-free from your RRSP to buy or build a qualifying home, and to repay the money to your RRSP over a period of up to 15 years. However, your predicament underscores why it’s important to read the fine print before you make any important financial decision.

The Canada Revenue Agency is very clear on the rules. “Your RRSP contributions must remain in the RRSP for at least 90 days before you can withdraw them under the HBP, or they may not be deductible for any year,” the CRA’s website says.

For example, if you made your RRSP contribution on Sept. 1, you would have to wait until Nov. 29 to withdraw the money, or you would not qualify for an RRSP deduction for the funds. (This is assuming you did not have any other money in the RRSP before you made the $25,000 contribution.)

There may be ways around the problem, however, says Camillo Lento, a chartered accountant and lecturer in accounting at Lakehead University.

For example, you could try to delay your closing date and withdrawal until after the 90-day period has passed. The CRA would then allow you to deduct the $25,000 from your income, potentially creating a tax refund.

You need to be aware of another rule, however. Before applying to withdraw funds under the HBP you must have a written agreement to buy or build a home, with the condition that your final withdrawal under the HBP can be no later than 30 days after the closing date. Any withdrawals after the 30-day period would be included in your income and subject to tax.

Keeping these rules in mind, Mr. Lento suggests another option: You could plan to close your home purchase, say, 62 days after you made the RRSP contribution, using a line of credit to make the down payment. You could then withdraw the $25,000 under the HBP 29 or 30 days later and pay off the line of credit. That way, you would meet both the 90-day and 30-day conditions and qualify for a refund.

“If he hasn’t purchased the house yet, he can probably make it work,” Mr. Lento says.

If you’ve already bought the house and it’s not an option to delay the closing, you can still access the $25,000 for your down payment by bypassing the HBP and just making a regular withdrawal from your RRSP, he says. In that case, you would be subject to withholding tax on the funds, but you would qualify for a deduction and tax refund. Ultimately, it would be a wash, because the $25,000 RRSP contribution and $25,000 withdrawal would cancel each other out.

Before you make a decision, I recommend you consult the CRA or a tax professional.

Source www.theglobeandmail.com/

The Home Buyers Plan is a great tool for first-time home buyers. It allows you to withdraw up to $25,000 tax-free from your RRSP to buy or build a qualifying home, and to repay the money to your RRSP over a period of up to 15 years. However, your predicament underscores why it’s important to read the fine print before you make any important financial decision.

The Canada Revenue Agency is very clear on the rules. “Your RRSP contributions must remain in the RRSP for at least 90 days before you can withdraw them under the HBP, or they may not be deductible for any year,” the CRA’s website says.

For example, if you made your RRSP contribution on Sept. 1, you would have to wait until Nov. 29 to withdraw the money, or you would not qualify for an RRSP deduction for the funds. (This is assuming you did not have any other money in the RRSP before you made the $25,000 contribution.)

There may be ways around the problem, however, says Camillo Lento, a chartered accountant and lecturer in accounting at Lakehead University.

For example, you could try to delay your closing date and withdrawal until after the 90-day period has passed. The CRA would then allow you to deduct the $25,000 from your income, potentially creating a tax refund.

You need to be aware of another rule, however. Before applying to withdraw funds under the HBP you must have a written agreement to buy or build a home, with the condition that your final withdrawal under the HBP can be no later than 30 days after the closing date. Any withdrawals after the 30-day period would be included in your income and subject to tax.

Keeping these rules in mind, Mr. Lento suggests another option: You could plan to close your home purchase, say, 62 days after you made the RRSP contribution, using a line of credit to make the down payment. You could then withdraw the $25,000 under the HBP 29 or 30 days later and pay off the line of credit. That way, you would meet both the 90-day and 30-day conditions and qualify for a refund.

“If he hasn’t purchased the house yet, he can probably make it work,” Mr. Lento says.

If you’ve already bought the house and it’s not an option to delay the closing, you can still access the $25,000 for your down payment by bypassing the HBP and just making a regular withdrawal from your RRSP, he says. In that case, you would be subject to withholding tax on the funds, but you would qualify for a deduction and tax refund. Ultimately, it would be a wash, because the $25,000 RRSP contribution and $25,000 withdrawal would cancel each other out.

Before you make a decision, I recommend you consult the CRA or a tax professional.

Source www.theglobeandmail.com/

Labels:

Affliate Marketing

New paint project makes Portland family shelter ‘more like a home’

By Seth Koenig, BDN Staff

Volunteer Heidi Fenwick of South Portland-based C.H. Rosengren Painting and Repairs gives a window frame at Portland's family shelter a fresh coat of Super White paint, donated by Benjamin Moore Paints. Buy Photo

PORTLAND, Maine — With paint donated by Benjamin Moore Paints and time donated by local painters, rooms in the city of Portland’s Chestnut Street family shelter got fresh coats of color Thursday, saving the city money and lifting morale at the site.

“Just by giving it fresh color, it seems more like a home and less like an institution,” said Katherine Moore, 27, who has been staying at the shelter with her husband and young son for about three days.

Moore and her husband both recently found jobs after returning home to Maine from California, where the economy hit them hard and left them unable to keep up with their bills.

“This place has been a great stepping stone,” Moore told the Bangor Daily News. “Without it, we would’ve been living out of our car until that first or second paycheck came in.”

Volunteers from several Portland-area companies helped apply the paint, including Stella Esposito Painting, Kelley Painting, Theodore Logan & Sons, and C.H. Rosengren Painting & Repairs.

The local work is part of Benjamin Moore’s Color Care Across America project, in which more than 7,000 gallons of paint are being donated to 60 shelters across the United States and Canada. Supporting the project are the United States Conference of Mayors and the Painting and Decorating Contractors of America.

“No. 1, it’s money the city isn’t spending,” Portland Mayor Nicholas Mavodones said Thursday. “No. 2, it creates a much brighter space. There’s a lot of people using this area, and it’s important to make it feel as much like a home as we can for them. These are people dealing with some of the most difficult experiences of their lives.”

The city’s family shelter at 54 Chestnut St., which includes a tandem building across the street, is currently at capacity housing 77 people.

“What we strive for is a safe, clean, dignified environment,” said Douglas Gardner, director of the city’s Department of Health and Human Services. “This grant opportunity has allowed us to get to a place where [rooms] are completely painted up, when that typically would have been done over the course of a year, month-by-month as we chipped away at it.”

Volunteer Heidi Fenwick of South Portland-based C.H. Rosengren Painting and Repairs gives a window frame at Portland's family shelter a fresh coat of Super White paint, donated by Benjamin Moore Paints. Buy Photo

PORTLAND, Maine — With paint donated by Benjamin Moore Paints and time donated by local painters, rooms in the city of Portland’s Chestnut Street family shelter got fresh coats of color Thursday, saving the city money and lifting morale at the site.

“Just by giving it fresh color, it seems more like a home and less like an institution,” said Katherine Moore, 27, who has been staying at the shelter with her husband and young son for about three days.

Moore and her husband both recently found jobs after returning home to Maine from California, where the economy hit them hard and left them unable to keep up with their bills.

“This place has been a great stepping stone,” Moore told the Bangor Daily News. “Without it, we would’ve been living out of our car until that first or second paycheck came in.”

Volunteers from several Portland-area companies helped apply the paint, including Stella Esposito Painting, Kelley Painting, Theodore Logan & Sons, and C.H. Rosengren Painting & Repairs.

The local work is part of Benjamin Moore’s Color Care Across America project, in which more than 7,000 gallons of paint are being donated to 60 shelters across the United States and Canada. Supporting the project are the United States Conference of Mayors and the Painting and Decorating Contractors of America.

“No. 1, it’s money the city isn’t spending,” Portland Mayor Nicholas Mavodones said Thursday. “No. 2, it creates a much brighter space. There’s a lot of people using this area, and it’s important to make it feel as much like a home as we can for them. These are people dealing with some of the most difficult experiences of their lives.”

The city’s family shelter at 54 Chestnut St., which includes a tandem building across the street, is currently at capacity housing 77 people.

“What we strive for is a safe, clean, dignified environment,” said Douglas Gardner, director of the city’s Department of Health and Human Services. “This grant opportunity has allowed us to get to a place where [rooms] are completely painted up, when that typically would have been done over the course of a year, month-by-month as we chipped away at it.”

Labels:

Affliate Marketing

Fannie Mae, Freddie Mac unlikely to need more taxpayer money, feds say

By Zachary A. Goldfarb

To date, the companies, which play a central role in the Obama administration’s response to the housing crisis, have cost taxpayers $141 billion.

But soon, Fannie and Freddie will begin to generate enough profit to begin to pay back taxpayers. Nonetheless, officials say the companies are unlikely to ever repay all the money, cementing their status as the financial crisis’s most expensive legacy.

What’s more, if the economy worsens significantly, the companies might need $50 billion more in taxpayer aid, as profit would fall short of covering the losses associated with more homeowners falling into foreclosure.

The new projections from the Federal Housing Finance Agency come during a challenging time for the companies. The Obama administration and Republicans have said flatly that they want to get rid of the companies, which helped fuel the financial crisis.

But Fannie and Freddie are increasingly being called on to help carry out the government’s response to the housing crisis.

On Monday, for example, President Obama and regulators announced a plan to allow borrowers who owe more than their properties are worth to refinance at today’s ultra-low mortgage rates. Fannie and Freddie will carry out the program.

Still, the lack of a clear path for the companies’ future has demoralized employees. On Wednesday, Freddie Mac’s chief executive and three board members said they planned to step down in the coming year.

Fannie and Freddie were seized in fall 2008, as the financial crisis entered its most serious phase. No companies were more exposed than Fannie and Freddie, which own or guarantee trillions of dollars in mortgages.

Many of these mortgages were given to homeowners who could no longer afford to pay their loans. That created tens of billions of dollars in losses for Fannie and Freddie.

Federal officials seized the companies so they could continue their essential role in the operation of the mortgage markets, which provide money to banks so they can make home loans.

Fannie and Freddie have recently reached an inflection point. They have already suffered most of the losses associated with the financial crisis and are beginning to make a profit on the many new home loans they’ve bought or guaranteed since the crisis. These loans are much safer because Fannie and Freddie sharply narrowed eligibility criteria for mortgages.

Fannie and Freddie must pay a hefty 10 percent dividend on money they borrow from taxpayers. This has led to an unusual situation in which Fannie and Freddie must borrow money from taxpayers to pay taxpayers back.

In the end, though, these funds are a wash.

Labels:

Affliate Marketing

Friday, 28 October 2011

Facts About Online Paid Surveys

by Jenn Prosskie

Making money online and from home can be a dream of many of us. To assist answer that question, even so, it may be better to solution the question of how online surveys work.

Item marketing and advertising is just not as easy as it seems. It demands a lot of hard work and creativity. To assist corporations with their work, they should know how individuals consider.

How it performs is like this; look up for paid survey web sites on your search engine, or to find definitely beneficial ones, study forums and look for users feedback’s to know which web sites would be the ones really worth signing up with.

You will find nevertheless some easy approaches to generate income. When I started feeling the pressure of earning capital just after quitting my occupation I had to discover a little something – swift. The answer came in the kind of online surveys. I discovered that I could earn dollars taking online surveys.

These providers team up with survey specialist corporations and start asking folks their opinion concerning the precise product and how it might be improved. You will discover a number of techniques of doing it, online surveys, online focus group, offline concentrate group, mobile phone surveys,mail surveys and in person interviews.

The largest challenge online is not in discovering a high paying survey, but rather in acquiring reputable surveys that actually pay. Many of the so-called free survey websites are only out to capture your personal particulars that they in turn sell off to registration firms.

First point you’ll want to do is acquiring a separate e-mail account. Why you inquire? Very well, to make any decent amount of funds by taking paid surveys, not surprisingly you are going to really need to sign up with as many survey sites as possible and also a couple of days following your registration you start to recieve a lot of survey invitations.

When you need extra cash then you can make it via project payday review. To know more about the false online job sites,you can view project payday.

Making money online and from home can be a dream of many of us. To assist answer that question, even so, it may be better to solution the question of how online surveys work.

Item marketing and advertising is just not as easy as it seems. It demands a lot of hard work and creativity. To assist corporations with their work, they should know how individuals consider.

How it performs is like this; look up for paid survey web sites on your search engine, or to find definitely beneficial ones, study forums and look for users feedback’s to know which web sites would be the ones really worth signing up with.

You will find nevertheless some easy approaches to generate income. When I started feeling the pressure of earning capital just after quitting my occupation I had to discover a little something – swift. The answer came in the kind of online surveys. I discovered that I could earn dollars taking online surveys.

These providers team up with survey specialist corporations and start asking folks their opinion concerning the precise product and how it might be improved. You will discover a number of techniques of doing it, online surveys, online focus group, offline concentrate group, mobile phone surveys,mail surveys and in person interviews.

The largest challenge online is not in discovering a high paying survey, but rather in acquiring reputable surveys that actually pay. Many of the so-called free survey websites are only out to capture your personal particulars that they in turn sell off to registration firms.

First point you’ll want to do is acquiring a separate e-mail account. Why you inquire? Very well, to make any decent amount of funds by taking paid surveys, not surprisingly you are going to really need to sign up with as many survey sites as possible and also a couple of days following your registration you start to recieve a lot of survey invitations.

When you need extra cash then you can make it via project payday review. To know more about the false online job sites,you can view project payday.

Labels:

Affliate Marketing

For a more comfortable and efficient winter

The following information has been provided by Ed Schwartz of Green Living Solutions.

Now is the time to think about taking steps to make your home more comfortable and keep r energy costs down this winter. There are simple and inexpensive ways to boost comfort, save money, and make a home more green. So before the shivering starts, try some of these easy fixes.

A Home Energy Audit is always a great place to start to help not only identify areas to save energy, but also to help prioritize the improvements that can be made. An energy audit identifies where energy is being used and wasted within the home. A certified home energy auditor can assist homeowners in prioritizing improvements, whether those priorities are comfort, indoor air quality, savings or minimizing environmental impact. Most people ask about windows, but there are usually many other areas to target, which cost less, and have much greater impact on comfort and reducing energy use.

To help keep costs down for homeowners, both the state and federal governments have rebates and incentives to help offset some of the costs. The Home Performance with Energy Star Program is available to all homeowners, and with its Fall 2011 promotion, can provide up to $5,000 per household to qualified homeowners to offset the cost of energy efficient upgrades. Learn more about state funded rebates and incentives at www.njcleanenergy.com and pick up more suggestions and have questions answered at www.askecoed.com .

Another area that can be addressed is the lighting in the home. In the dark months of winter, we all tend to keep the lights on for more hours, increasing electricity bills. By swapping out your incandescent bulbs for compact fluorescent or LED bulbs (both available at most hardware stores), you can keep electrical bills down without sacrificing light quality. Even festive holiday lights are now available in more efficient LED's, that also last significantly longer than the standard incandescent bulbs. In addition, many exterior holiday lights can be both LED and solar powered, requiring no electricity. Check the local hardware retailer, or visit www.efi.org for a variety of energy saving lights. Do not wait until the current bulbs burn out. They waste so much electricity that it pays to change them now. And train the kids, and perhaps the spouse, to turn off lights when leaving the room.

Check the attic insulation. Fiberglass does little to block air movement. It is estimated that roughly 90 percent of homes in New Jersey are under-insulated by current Energy Star standards. Older homes may not even have insulation in the walls. Drafts can be blocked. Some are easy to find, and simple low-tech solutions are often the best. The fireplace damper is a common culprit. Be sure to close the damper in the fireplace when not in use. If the seal is not good, then a "Chimney Balloon" is an inexpensive way to block cold air movement. A door cozy or door sweep are both handy little items that block the drafts that creep in underneath the doorways. Caulk or weather stripping around doors and windows are products that almost anyone can use to minimize drafts and heating bills and increase comfort.

Heating systems use by far the most energy in the home in winter. Properly tuned equipment will help it last longer and run more efficiently. Newer technologies are so much more efficient, that it might make sense to upgrade an older system. Installing and properly setting a programmable thermostat can also reduce energy wasted over night or when no one is home.

Get the whole family involved. Saving energy can be fun, makes a home more comfortable, keeps energy bills down, all while making the home more Earth-friendly.

Eco Ed is a co-founder of Green Living Solutions, certified by the Building Performance Institute. Visit www.greenlivingsolutionsnj.com for additional information.

Source www.northjersey.com/

Now is the time to think about taking steps to make your home more comfortable and keep r energy costs down this winter. There are simple and inexpensive ways to boost comfort, save money, and make a home more green. So before the shivering starts, try some of these easy fixes.

A Home Energy Audit is always a great place to start to help not only identify areas to save energy, but also to help prioritize the improvements that can be made. An energy audit identifies where energy is being used and wasted within the home. A certified home energy auditor can assist homeowners in prioritizing improvements, whether those priorities are comfort, indoor air quality, savings or minimizing environmental impact. Most people ask about windows, but there are usually many other areas to target, which cost less, and have much greater impact on comfort and reducing energy use.

To help keep costs down for homeowners, both the state and federal governments have rebates and incentives to help offset some of the costs. The Home Performance with Energy Star Program is available to all homeowners, and with its Fall 2011 promotion, can provide up to $5,000 per household to qualified homeowners to offset the cost of energy efficient upgrades. Learn more about state funded rebates and incentives at www.njcleanenergy.com and pick up more suggestions and have questions answered at www.askecoed.com .

Another area that can be addressed is the lighting in the home. In the dark months of winter, we all tend to keep the lights on for more hours, increasing electricity bills. By swapping out your incandescent bulbs for compact fluorescent or LED bulbs (both available at most hardware stores), you can keep electrical bills down without sacrificing light quality. Even festive holiday lights are now available in more efficient LED's, that also last significantly longer than the standard incandescent bulbs. In addition, many exterior holiday lights can be both LED and solar powered, requiring no electricity. Check the local hardware retailer, or visit www.efi.org for a variety of energy saving lights. Do not wait until the current bulbs burn out. They waste so much electricity that it pays to change them now. And train the kids, and perhaps the spouse, to turn off lights when leaving the room.

Check the attic insulation. Fiberglass does little to block air movement. It is estimated that roughly 90 percent of homes in New Jersey are under-insulated by current Energy Star standards. Older homes may not even have insulation in the walls. Drafts can be blocked. Some are easy to find, and simple low-tech solutions are often the best. The fireplace damper is a common culprit. Be sure to close the damper in the fireplace when not in use. If the seal is not good, then a "Chimney Balloon" is an inexpensive way to block cold air movement. A door cozy or door sweep are both handy little items that block the drafts that creep in underneath the doorways. Caulk or weather stripping around doors and windows are products that almost anyone can use to minimize drafts and heating bills and increase comfort.

Heating systems use by far the most energy in the home in winter. Properly tuned equipment will help it last longer and run more efficiently. Newer technologies are so much more efficient, that it might make sense to upgrade an older system. Installing and properly setting a programmable thermostat can also reduce energy wasted over night or when no one is home.

Get the whole family involved. Saving energy can be fun, makes a home more comfortable, keeps energy bills down, all while making the home more Earth-friendly.

Eco Ed is a co-founder of Green Living Solutions, certified by the Building Performance Institute. Visit www.greenlivingsolutionsnj.com for additional information.

Source www.northjersey.com/

Labels:

Affliate Marketing

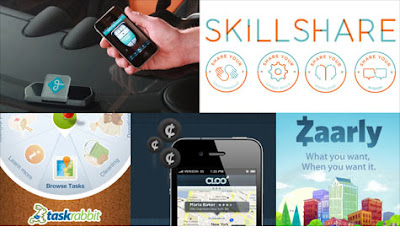

Apps let you rent out your home - and yourself

By Laurie Segall @CNNMoneyTech

NEW YORK (CNNMoney) -- If nature calls at 8.00 a.m. on your Starbucks run, good luck trying to use the bathroom. Chances are you'll find long lines, an out-of-order sign, or a loo hog who ties up the facilities a touch too long.

So the crew behind Cloo came up with a proposed solution: An app that lets you rent a pit stop. Pull up your iPhone, click a few buttons, and find a nearby person willing to time-share their toilets. Cloo's founders claim they're actively developing this app and plan to release it early next year.

Strange? Yep. But it's just the latest and oddest example of a broader trend: apps to let you share everything in your life. We're not talking about sharing your thoughts through tweets or Facebook status updates. These apps want you to rent out your home, your car and even yourself.

Rent-your-home site Airbnb, which launched in 2008, was one of the early pioneers. It has now booked more than 3 million nights on the service and lists property rentals in nearly 20,000 cities around the world. Investors sank more than $100 million into the venture in a recent funding round.

Getaround, a peer-to-peer car sharing service that allows users to rent out their vehicles when they're not using them, took home the grand prize at TechCrunch Disrupt in May. Meanwhile, the tech community is buzzing about Skillshare, a New York-based service that allows anyone to become a teacher and make extra cash coaching others on their hobbies and skills.

And then there's TaskRabbit, which lets you rent out your spare time. Customers can hire TaskRabbits to do everything from running errands to drafting love letters.

"I think people are going to become more comfortable about the idea of sharing things between their neighbors both online and offline, and so I see all of these markets really [becoming] more mainstream," TaskRabbit founder Leah Busque says.

Zaarly falls into a similar category. The new company serves as a marketplace that allows people to outsource tasks and buy products from people in their community. Its big bet -- that traditional e-commerce is evolving -- drew a $14 million investment this week from Kleiner Perkins Caufield & Byers.

"I'm a big believer that we're going through a pretty macro shift in the economy," says Craig Shapiro, founder of Collaborative Fund, which invests in early-stage "collaborative consumption" startups. "For so long we were ingrained to own stuff -- it was hyper consumption. I think there's a massive change, and we're at the beginning of sharing resources."

One of Shapiro's investments is Rentcycle, a company that stops short of peer-to peer rentals and lets people rent equipment, clothes and other goods from local stores.

CEO Tim Hyer thinks we're in the beginning phases of a shift.

"The recession was a big force in this movement. The idea of people just having less money to spend and less resources forced people to live within their means a little more," he says. "Rather than putting a lot of investment in things, you can pay for access rather than ownership."

But Hyer isn't yet offering peer-to peer rentals, mainly due to security concerns.

Underlying all of these sharing apps is the question of trust. Before I open up my bathroom to the public, I've got to know who I'm letting in the door. The last thing you want to do is rent out your home to a meth addict -- one recent Airbnb horror story. And what happens if your TaskRabbit shows up with a weapon?

But Busque thinks that the evolution of social networks like Facebook has helped make the technology smarter, and in turn, safer.

"Five years ago there's no way we could have built TaskRabbit and leveraged the technology pieces that we've done today -- things like social networking, mobile platforms and location-based analysis are all key components to building trust really between people," she says.

After one woman had her house ransacked after renting it on Airbnb, the company created a $50,000 insurance policy and doubled the size of its customer support team. To reassure those concerned about renting out their vehicles, Getaround teamed up with insurance giant Berkshire Hathaway.

Shapiro thinks that as the trend continues to grow, people will begin to develop an online reputation similar to their financial reputation in the credit realm.

"Instead of measuring financial health, you need to be able to look someone up and say 'is he trustworthy'?" he said.

That's a top item on his wish list for the Collaborative Fund's portfolio: A venture with a good formula for measuring trust online, to facilitate transferring it from the online world to the offline sharing realm.

"That's the area we're really looking at from an investment perceptive," he says.

But ultimately, it's up to people decide how much they'll share -- and where they'll draw the line.

For me? For the time being, my bathroom is closed to the public.

NEW YORK (CNNMoney) -- If nature calls at 8.00 a.m. on your Starbucks run, good luck trying to use the bathroom. Chances are you'll find long lines, an out-of-order sign, or a loo hog who ties up the facilities a touch too long.

So the crew behind Cloo came up with a proposed solution: An app that lets you rent a pit stop. Pull up your iPhone, click a few buttons, and find a nearby person willing to time-share their toilets. Cloo's founders claim they're actively developing this app and plan to release it early next year.

Strange? Yep. But it's just the latest and oddest example of a broader trend: apps to let you share everything in your life. We're not talking about sharing your thoughts through tweets or Facebook status updates. These apps want you to rent out your home, your car and even yourself.

Rent-your-home site Airbnb, which launched in 2008, was one of the early pioneers. It has now booked more than 3 million nights on the service and lists property rentals in nearly 20,000 cities around the world. Investors sank more than $100 million into the venture in a recent funding round.

Getaround, a peer-to-peer car sharing service that allows users to rent out their vehicles when they're not using them, took home the grand prize at TechCrunch Disrupt in May. Meanwhile, the tech community is buzzing about Skillshare, a New York-based service that allows anyone to become a teacher and make extra cash coaching others on their hobbies and skills.

And then there's TaskRabbit, which lets you rent out your spare time. Customers can hire TaskRabbits to do everything from running errands to drafting love letters.

"I think people are going to become more comfortable about the idea of sharing things between their neighbors both online and offline, and so I see all of these markets really [becoming] more mainstream," TaskRabbit founder Leah Busque says.

Zaarly falls into a similar category. The new company serves as a marketplace that allows people to outsource tasks and buy products from people in their community. Its big bet -- that traditional e-commerce is evolving -- drew a $14 million investment this week from Kleiner Perkins Caufield & Byers.

"I'm a big believer that we're going through a pretty macro shift in the economy," says Craig Shapiro, founder of Collaborative Fund, which invests in early-stage "collaborative consumption" startups. "For so long we were ingrained to own stuff -- it was hyper consumption. I think there's a massive change, and we're at the beginning of sharing resources."

One of Shapiro's investments is Rentcycle, a company that stops short of peer-to peer rentals and lets people rent equipment, clothes and other goods from local stores.

CEO Tim Hyer thinks we're in the beginning phases of a shift.

"The recession was a big force in this movement. The idea of people just having less money to spend and less resources forced people to live within their means a little more," he says. "Rather than putting a lot of investment in things, you can pay for access rather than ownership."

But Hyer isn't yet offering peer-to peer rentals, mainly due to security concerns.

Underlying all of these sharing apps is the question of trust. Before I open up my bathroom to the public, I've got to know who I'm letting in the door. The last thing you want to do is rent out your home to a meth addict -- one recent Airbnb horror story. And what happens if your TaskRabbit shows up with a weapon?

But Busque thinks that the evolution of social networks like Facebook has helped make the technology smarter, and in turn, safer.

"Five years ago there's no way we could have built TaskRabbit and leveraged the technology pieces that we've done today -- things like social networking, mobile platforms and location-based analysis are all key components to building trust really between people," she says.

After one woman had her house ransacked after renting it on Airbnb, the company created a $50,000 insurance policy and doubled the size of its customer support team. To reassure those concerned about renting out their vehicles, Getaround teamed up with insurance giant Berkshire Hathaway.

Shapiro thinks that as the trend continues to grow, people will begin to develop an online reputation similar to their financial reputation in the credit realm.

"Instead of measuring financial health, you need to be able to look someone up and say 'is he trustworthy'?" he said.

That's a top item on his wish list for the Collaborative Fund's portfolio: A venture with a good formula for measuring trust online, to facilitate transferring it from the online world to the offline sharing realm.

"That's the area we're really looking at from an investment perceptive," he says.

But ultimately, it's up to people decide how much they'll share -- and where they'll draw the line.

For me? For the time being, my bathroom is closed to the public.

Labels:

Affliate Marketing

Crony Capitalism Comes Home

By NICHOLAS D. KRISTOF

Whenever I write about Occupy Wall Street, some readers ask me if the protesters really are half-naked Communists aiming to bring down the American economic system when they’re not doing drugs or having sex in public.

The answer is no. That alarmist view of the movement is a credit to the (prurient) imagination of its critics, and voyeurs of Occupy Wall Street will be disappointed. More important, while alarmists seem to think that the movement is a “mob” trying to overthrow capitalism, one can make a case that, on the contrary, it highlights the need to restore basic capitalist principles like accountability.To put it another way, this is a chance to save capitalism from crony capitalists.

I’m as passionate a believer in capitalism as anyone. My Krzysztofowicz cousins (who didn’t shorten the family name) lived in Poland, and their experience with Communism taught me that the way to raise living standards is capitalism.

But, in recent years, some financiers have chosen to live in a government-backed featherbed. Their platform seems to be socialism for tycoons and capitalism for the rest of us. They’re not evil at all. But when the system allows you more than your fair share, it’s human to grab. That’s what explains featherbedding by both unions and tycoons, and both are impediments to a well-functioning market economy.

When I lived in Asia and covered the financial crisis there in the late 1990s, American government officials spoke scathingly about “crony capitalism” in the region. As Lawrence Summers, then a deputy Treasury secretary, put it in a speech in August 1998: “In Asia, the problems related to ‘crony capitalism’ are at the heart of this crisis, and that is why structural reforms must be a major part” of the International Monetary Fund’s solution.

The American critique of the Asian crisis was correct. The countries involved were nominally capitalist but needed major reforms to create accountability and competitive markets.

Something similar is true today of the United States.

So I’d like to invite the finance ministers of Thailand, South Korea and Indonesia — whom I and other Americans deemed emblems of crony capitalism in the 1990s — to stand up and denounce American crony capitalism today.

Capitalism is so successful an economic system partly because of an internal discipline that allows for loss and even bankruptcy. It’s the possibility of failure that creates the opportunity for triumph. Yet many of America’s major banks are too big to fail, so they can privatize profits while socializing risk.

The upshot is that financial institutions boost leverage in search of supersize profits and bonuses. Banks pretend that risk is eliminated because it’s securitized. Rating agencies accept money to issue an imprimatur that turns out to be meaningless. The system teeters, and then the taxpayer rushes in to bail bankers out. Where’s the accountability?

It’s not just rabble-rousers at Occupy Wall Street who are seeking to put America’s capitalists on a more capitalist footing.

“Structural change is necessary,” Paul Volcker, the former chairman of the Federal Reserve, said in an important speech last month that discussed many of these themes. He called for more curbs on big banks, possibly including trimming their size, and he warned that otherwise we’re on a path of “increasingly frequent, complex and dangerous financial breakdowns.”

Likewise, Mohamed El-Erian, another pillar of the financial world who is the chief executive of Pimco, one of the world’s largest money managers, is sympathetic to aspects of the Occupy movement. He told me that the economic system needs to move toward “inclusive capitalism” and embrace broad-based job creation while curbing excessive inequality.

“You cannot be a good house in a rapidly deteriorating neighborhood,” he told me. “The credibility and the fair functioning of the neighborhood matter a great deal. Without that, the integrity of the capitalist system will weaken further.”

Lawrence Katz, a Harvard economist, adds that some inequality is necessary to create incentives in a capitalist economy but that “too much inequality can harm the efficient operation of the economy.” In particular, he says, excessive inequality can have two perverse consequences: first, the very wealthy lobby for favors, contracts and bailouts that distort markets; and, second, growing inequality undermines the ability of the poorest to invest in their own education.

“These factors mean that high inequality can generate further high inequality and eventually poor economic growth,” Professor Katz said.

Does that ring a bell?

So, yes, we face a threat to our capitalist system. But it’s not coming from half-naked anarchists manning the barricades at Occupy Wall Street protests. Rather, it comes from pinstriped apologists for a financial system that glides along without enough of the discipline of failure and that produces soaring inequality, socialist bank bailouts and unaccountable executives.

It’s time to take the crony out of capitalism, right here at home.

Labels:

Affliate Marketing

Stern Advice: Reverse mortgages appeal to younger homeowners

By Linda Stern

(Reuters) - The typical reverse mortgage borrower isn't who you think she is. Instead of the elderly woman you may be picturing, think of a married couple who is a bit younger.

New reverse mortgage applicants tend to be clustered around ages 62 and 63, according to Peter Bell, president of the National Reverse Mortgage Lenders Association. And they are as likely to be couples as singletons.

That's a change from 15 years ago, when the recently widowed 75-year-old woman was their most common applicant.

In a typical reverse mortgage arrangement, a homeowner will borrow money against the equity in his home, but not have to make any payments on it until the home is sold.

The new younger borrowers often pay off these loans more quickly than the elderly borrowers of yore. They use them as a transitional way to fund retirement, says Bell -- living off of reverse mortgage income during the early retirements and then selling their homes, paying off loans and downsizing later.

That may make sense for a boomer generation that is said to hold half of its net worth in home equity. But it can also be a costly strategy and one laden with upfront fees and complexities.

The newly created Consumer Financial Protection Bureau is studying the risks of reverse mortgages and the AARP has filed lawsuits claiming bad behavior on the part of lenders and federal agencies in the way they have administered reverse mortgages.

"My observation is that you have to be very, very, very careful with a reverse mortgage," says Susan Fulton, a Bethesda, Maryland, fee-only financial adviser. "Before you take one out, get at least two opinions from experts who can look it over."

Jean Constantine-Davis, the attorney who has pressed litigation on these mortgages for the AARP, doesn't think they are always a bad idea. "I'm not down on the product," she says. "I just think it's a product for a very narrow group of people."

If you think you might be in that narrow group, here are some considerations.

-- Look at the numbers. Bell's group offers a full-featured reverse mortgage calculator at www.reversemortgage.org. Put in your zip code, age and home value, and you will be able to see how much you can borrow AND how much it will cost you.

For example, a 62-year-old with a $500,000 Maryland house could borrow as much as $306,323 at a variable rate starting at 3.99 percent. But it would cost as much as $27,701 in up-front closing costs and reverse mortgage insurance. Note that the vast majority of reverse mortgages are part of the Home Equity Conversion Mortgage (HECM) program guaranteed by the federal government, and while some lenders may charge somewhat more or less than others, some of the fees are established by HUD.

-- Think very long term. Obviously, if you're going to spend that much money upfront to nail down one of these loans, you need to make sure you're going to use it for a long time. If you end up selling the home a year later, you will have paid an effective interest rate that is more than 10 percent. The longer you're in the loan, the less costly those upfront fees will be.

-- Weigh the choices. That same borrower could pay less up front if she were willing to borrow less and take a so-called HECM Saver loan. You can also opt for a fixed-rate reverse mortgage, which could protect you if you expect to hold it for many years and rates rise. But it could end up being expensive, because in the typical reverse mortgage, you don't have to tap all of the money at once, but if it's a fixed rate loan, you do have to borrow the full amount when you take the loan.

-- Don't go solo if you're married. Most of the problems Constantine-Davis has seen involve older couples where the lender convinced the borrower to remove the younger spouse from the home deed and therefore, the loan. That enables the borrower to get more cash out of the house, but also makes the loan become due when that borrowing spouse dies. It can leave the second spouse in the lurch. It's safer to make sure both homeowners are on the deed.

-- Look at other alternatives. If you have home equity and are not squeezed to the max, consider a regular home equity line of credit first, suggests Fulton. You'll have to make payments, but you will have extra cash available for home repairs and emergencies, typically at lower rates and costs, than you will with a reverse loan. She tells strapped retirees that they are better off selling their home, pulling out their equity and downsizing than hanging onto a home they cannot afford. When you have a reverse mortgage, you still have to make sure you have enough cash to keep up with the real estate taxes or home insurance.

-- Don't take a reverse loan just to invest money. Some folks have been talked into borrowing against their homes just to hand money to an unscrupulous salesperson pushing expensive annuities. It's rarely a good idea to pull money out of your house at comparatively high costs, just to buy another financial product. If the same person that's peddling the loan is also telling you what to do with the proceeds, beware.

(The Personal Finance column appears weekly. Linda Stern can be reached at linda.stern(at)thomsonreuters.com)

(Editing by Maureen Bav)

Labels:

Affliate Marketing

Why there are still opportunities to make money in Irish shares

Renowned investment manager Gervais Williams has long been a cheerleader for smaller stockmarket-listed companies. In an exclusive extract from his new book, Williams says companies like Greencore, FBD and Smurfit Kappa have the potential to offer good returns for investors and outlines his stock-picking strategy.

INVESTORS are wondering how to make good decisions in these uncertain times. The problem seems more difficult than ever now as the financial crisis has scuppered the trends that have successfully guided investors over the past 25 years.

But there are still good opportunities for making money in the stockmarket, even amongst Irish companies.

The conundrum facing investors now is the central theme in my new book, 'Slow Finance'.

In it, I start by emphasising that the first and most critical point to appreciate is how important credit growth has been in driving stockmarket trends in the past two decades or more.

Relationship

Before 1986, credit growth grew broadly in line with economic growth, but a powerful combination of deregulation, innovation and globalisation allowed this relationship to change.

Much faster credit growth contributed to higher asset prices and this subsequently encouraged speculative activity to grow year after year in the financial markets.

So, at the end of the credit boom we have a financial sector that is enormous and is out of a scale with what is needed in the world's shrunken economies.

If the credit boom has come to an end, then the drivers of the previous trend will cease. And if the previous debt mountain starts to be repaid, then the previous trend will reverse.

This means the financial sector will be forced to scale back to something more in balance with the underlying economy.

We know that the process is going to take some time, but the key question for those with savings is what might be the new investment trends that attract support in the coming years?

Already there have been indications of a profound change of attitudes to the financial sector. The speed and the growth of the Occupy demonstrations worldwide are a firm indication of that.

In my view, we are likely to see an equally profound change in the values and beliefs of those involved in the investment markets.

Indeed, following the globalisation of the food sector, the subsequent trend has been for many individuals to seek to take a more active role in deciding the quality of ingredients, for example.

I believe we are likely to see a similar trend in the financial sector and savers will expect to want a lot more influence on the decisions that determine where their savings are allocated.

Investors in recent years have all been looking for growth. If growth is good, then the fastest growth has delivered the best returns.

With the end of the credit boom, though, it seems the faster growth of recent years is being replaced by something of a growth hangover.

Problem

This, in essence, is the problem that western governments are now grappling with.

Governments are also struggling to find the money to maintain spending in the economy and the uncertainty of austerity is causing investment markets to become highly volatile.

In this scenario, investors would be well advised to reflect on what has happened in the past and what guided seasoned investors at times of even greater uncertainty.

Perhaps the most notable is Benjamin Graham, author of 'The Intelligent Investor'.

Graham's book reminds us that many investors seek to buy shares that are on the rise in the hope of selling them later at a decent profit.

He characterises this as speculation, rather than true investment. The better way to make good returns, Graham argues, is to get involved with assets when they have intrinsic value and then to be willing to hold on to these investments over a long period.

Part owners

By doing this, investors begin to act as part owners of the companies they invest in and take on all of those responsibilities, rather than relying on making a profit though making a few transactions.

If the investments are selected based on the underlying value of the company, the short-term movements of markets are not so unsettling, since markets do stabilise in time and the real value of an investment does deliver. For that reason, my book characterises this trend as 'slow'.

The implications of such a change in attitude are far-reaching. If savers seek to invest with a longer timeframe, then the underlying stocks had better be really worthwhile.

This suggests that selecting stocks that are undervalued based on their share price will become a lot more important, rather than just investing in the largest quoted businesses listed on a stockmarket index.

And while there are benefits to investing in stockmarkets outside of Ireland to diversify your investments, the chances are that the best opportunities to identify those with real underlying value are likely to be nearer home.

The Irish stockmarket is way out of fashion with international investors, so it seems logical that there must be some stocks that offer a good entry price for investors.

Graham suggested one way of identifying these shares might be to compare the tangible assets within a company with the stockmarket value of the company -- a concept known as 'value investing'.

There are many academic studies that show that using this method over time does indeed lead to premium returns for investors.

Other academic studies have demonstrated that those companies with good and growing dividends also tend to deliver handsomely.

During the credit boom, the prospect of quick capital gains outshone the huge benefit of holding dividend-paying companies and reinvesting that income, which has traditionally proved to be a good bet.

So despite the fact that the prospects for the Irish economy are unexciting, my clients' portfolios do hold some Irish companies.

They have selected stocks that appear to offer good underlying value and have the potential to deliver income from dividends.

Our largest holding is Greencore, the food-manufacturing business. Although this company has made a series of acquisitions, so it doesn't have a high tangible-asset value, its strong market position has attracted interest which this week resulted in a potential takeover approach.

Another is FBD, the insurance business, which in spite of the Dublin floods this week, seems to me to have attractive long-term prospects of decent dividend growth.

We also hold smaller investments in DCC, CRH and probably most controversially in Smurfit Kappa. The wisdom or otherwise of my investment selections will become apparent in time.

The point is that simple strategies like reinvesting dividend income, using the power of compounding to grow wealth slowly, can be sustained irrespective of whether Greece does or does not default.

With change all around us, do check your assumptions about where to focus. The growth story has been at the forefront for most of the past 25 years. But it has been recognised for a long time that investors tend to overpay for growth.

And the bottom line is that, since 1975, returns from more mature economies have often matched or outstripped those from rapid-growth economies.

Gervais Williams ran Gartmore, the successful investment-funds group, for 17 years specialising in investing clients' funds in smaller, publicly quoted companies.

He now has a new role at MAM Funds, a company listed on London's Alternative Investment Market (AIM).

His new book, 'Slow Finance', is published by Bloomsbury and comes with a free smartphone App, highlighting value, dividend yield, size and investment miles in UK-listed companies, using data from Thomson Reuters.

Source www.independent.ie/

INVESTORS are wondering how to make good decisions in these uncertain times. The problem seems more difficult than ever now as the financial crisis has scuppered the trends that have successfully guided investors over the past 25 years.

But there are still good opportunities for making money in the stockmarket, even amongst Irish companies.

The conundrum facing investors now is the central theme in my new book, 'Slow Finance'.

In it, I start by emphasising that the first and most critical point to appreciate is how important credit growth has been in driving stockmarket trends in the past two decades or more.

Relationship

Before 1986, credit growth grew broadly in line with economic growth, but a powerful combination of deregulation, innovation and globalisation allowed this relationship to change.

Much faster credit growth contributed to higher asset prices and this subsequently encouraged speculative activity to grow year after year in the financial markets.

So, at the end of the credit boom we have a financial sector that is enormous and is out of a scale with what is needed in the world's shrunken economies.

If the credit boom has come to an end, then the drivers of the previous trend will cease. And if the previous debt mountain starts to be repaid, then the previous trend will reverse.

This means the financial sector will be forced to scale back to something more in balance with the underlying economy.

We know that the process is going to take some time, but the key question for those with savings is what might be the new investment trends that attract support in the coming years?

Already there have been indications of a profound change of attitudes to the financial sector. The speed and the growth of the Occupy demonstrations worldwide are a firm indication of that.

In my view, we are likely to see an equally profound change in the values and beliefs of those involved in the investment markets.

Indeed, following the globalisation of the food sector, the subsequent trend has been for many individuals to seek to take a more active role in deciding the quality of ingredients, for example.

I believe we are likely to see a similar trend in the financial sector and savers will expect to want a lot more influence on the decisions that determine where their savings are allocated.

Investors in recent years have all been looking for growth. If growth is good, then the fastest growth has delivered the best returns.

With the end of the credit boom, though, it seems the faster growth of recent years is being replaced by something of a growth hangover.

Problem

This, in essence, is the problem that western governments are now grappling with.

Governments are also struggling to find the money to maintain spending in the economy and the uncertainty of austerity is causing investment markets to become highly volatile.

In this scenario, investors would be well advised to reflect on what has happened in the past and what guided seasoned investors at times of even greater uncertainty.

Perhaps the most notable is Benjamin Graham, author of 'The Intelligent Investor'.

Graham's book reminds us that many investors seek to buy shares that are on the rise in the hope of selling them later at a decent profit.

He characterises this as speculation, rather than true investment. The better way to make good returns, Graham argues, is to get involved with assets when they have intrinsic value and then to be willing to hold on to these investments over a long period.

Part owners

By doing this, investors begin to act as part owners of the companies they invest in and take on all of those responsibilities, rather than relying on making a profit though making a few transactions.

If the investments are selected based on the underlying value of the company, the short-term movements of markets are not so unsettling, since markets do stabilise in time and the real value of an investment does deliver. For that reason, my book characterises this trend as 'slow'.

The implications of such a change in attitude are far-reaching. If savers seek to invest with a longer timeframe, then the underlying stocks had better be really worthwhile.

This suggests that selecting stocks that are undervalued based on their share price will become a lot more important, rather than just investing in the largest quoted businesses listed on a stockmarket index.

And while there are benefits to investing in stockmarkets outside of Ireland to diversify your investments, the chances are that the best opportunities to identify those with real underlying value are likely to be nearer home.

The Irish stockmarket is way out of fashion with international investors, so it seems logical that there must be some stocks that offer a good entry price for investors.

Graham suggested one way of identifying these shares might be to compare the tangible assets within a company with the stockmarket value of the company -- a concept known as 'value investing'.

There are many academic studies that show that using this method over time does indeed lead to premium returns for investors.

Other academic studies have demonstrated that those companies with good and growing dividends also tend to deliver handsomely.

During the credit boom, the prospect of quick capital gains outshone the huge benefit of holding dividend-paying companies and reinvesting that income, which has traditionally proved to be a good bet.

So despite the fact that the prospects for the Irish economy are unexciting, my clients' portfolios do hold some Irish companies.

They have selected stocks that appear to offer good underlying value and have the potential to deliver income from dividends.

Our largest holding is Greencore, the food-manufacturing business. Although this company has made a series of acquisitions, so it doesn't have a high tangible-asset value, its strong market position has attracted interest which this week resulted in a potential takeover approach.

Another is FBD, the insurance business, which in spite of the Dublin floods this week, seems to me to have attractive long-term prospects of decent dividend growth.

We also hold smaller investments in DCC, CRH and probably most controversially in Smurfit Kappa. The wisdom or otherwise of my investment selections will become apparent in time.

The point is that simple strategies like reinvesting dividend income, using the power of compounding to grow wealth slowly, can be sustained irrespective of whether Greece does or does not default.

With change all around us, do check your assumptions about where to focus. The growth story has been at the forefront for most of the past 25 years. But it has been recognised for a long time that investors tend to overpay for growth.

And the bottom line is that, since 1975, returns from more mature economies have often matched or outstripped those from rapid-growth economies.

Gervais Williams ran Gartmore, the successful investment-funds group, for 17 years specialising in investing clients' funds in smaller, publicly quoted companies.

He now has a new role at MAM Funds, a company listed on London's Alternative Investment Market (AIM).

His new book, 'Slow Finance', is published by Bloomsbury and comes with a free smartphone App, highlighting value, dividend yield, size and investment miles in UK-listed companies, using data from Thomson Reuters.

Source www.independent.ie/

Labels:

Affliate Marketing

Moms find ways to work at home

By JENNIFER STULTZ

Staff Writer

Three Marion County moms supplement their household income, yet still stay at home with their children.

According to the Home Based Working Moms Network, a professional online organization, today, more than ever before, parents are trying to find ways to stay with their children, and many are finding it makes financial sense.

Amy Sterk of rural Goessel, Rachel Burkholder of rural Hillsboro, and Kelly Krch of rural Lincolnville have jobs that allow them to work out of home offices.

“If I couldn’t work at home, I wouldn’t be working,” Sterk said. “My priority is being available to my kids and their needs. I like being able to go to their activities during the day and being at home when they get home from school.”

Sterk works from her home office as a Christian resource distributor. She is the only customer service representative in the United States for a Canadian company.

“I have two bookshelves of material in my office so I do a little bit of shipping,” Sterk said. “But mostly I am linked to the head office with my computer and all work is done electronically.”