Saturday, 3 September 2011

The Next Home Run Energy Stock

Investors can make big money from misunderstood companies. Recently, I’ve zeroed in on a company that the market is unfairly punishing with a 40% drop in the share price in the past month -- compared to a 5.4% drop in the Dow Jones (INDEX: ^DJI) -- after two spinoffs, a joint venture announcement, and an earnings miss. The company’s strategy, management team, and assets have me excited that this stock could produce huge returns over the years ahead.

The company is SandRidge Energy (NYSE: SD ) . Founded in 2006 by Tom Ward, a co-founder of Chesapeake Energy (NYSE: CHK ) with Aubrey McClendon, the company initially focused on natural gas before switching its focus to oil in 2009 and 2010 with the acquisitions of oil assets Forest Oil’s Permian Basin Assets and Arena Resources.

AssetsSandRidge is currently trading for $3 billion. It has preferred stock of $765 million and a large debt load of $2.9 billion but no maturities until 2014 ($350 million in 2014, $350 million in 2016, the rest not till 2018 and later). As of the end of 2010, SandRidge’s reserves had a net present value (PV-10) of $4.5 billion. Its reserves mainly come from two large assets, 900,000 acres in the Mississippian and 220,000 acres in the Permian Basin. SandRidge currently has 16 rigs operating in the Permian Basin and 14 rigs operating in the Mississippian, making it the third-largest operator of rigs in the U.S. dedicated to oil drilling, behind Chesapeake and EOG Resources (NYSE: EOG ) .

StrategyThe company’s strategy has been to spend heavily on drilling its properties, so heavily, in fact, that capital expenditures have been significantly higher than cash flow for the past few years and are expected to continue to be higher until 2014. Earlier in the year, the company planned for $1.3 billion in capital spending for 2011 versus $400 million in cash flow last year, and $1.8 billion to $2 billion for 2012-2014.

However, in its second-quarter earnings announcement, SandRidge stated, "we have identified and established an acreage position in a new area that is similar in size, characteristics and cost to our first Mississippian play." As such, they increased this year’s CAPEX by $500 million to $1.8 billion, with $275 million for land acquisitions in the new play, an additional $200 million for drilling expenditures, and $25 million for oil-field services.

The market pummeled the stock, as it is wary of SandRidge’s debt load and would rather the company spend cash on drilling instead of acquiring land. However, if SandRidge has indeed found a promising new play and is buying land very inexpensively, it could prove to be a boon to shareholders in the next few years.

The large capital expenditures on drilling will lead to quickly expanding cash flow with EBITDA expected to be $730 million in 2011, $1 billion in 2012, and $1.35 billion in 2013. Until the company can fund all its drilling with cash flow, it plans on funding capex through debt and alternative financing (asset sales, joint ventures, and royalty trusts).

This year’s capex will be funded with $450 million in cash flows from operations, the cash from two spinoffs of royalty trusts -- the SandRidge Mississippian Trust I (NYSE: SDT ) and the SandRidge Permian Trust (NYSE: PER ) -- and asset sales of some smaller fields. For 2012 to 2014, the company plans on funding its capex with $3 billion in cash flow from operations, a joint venture with Atinum Partners, $1 billion in alternative financing, and $1.4 billion in debt.

The company’s huge capex spending should lead to comparable growth in cash flow from operations. By the end of 2014, Ward expects to achieve EBITDA of more than $2 billion, to grow production annually by double digits, to fund its capital expenditures with its cash flow, and to achieve a debt-to-EBITDA ratio of less than 2:1.

OpportunitySandRidge’s competitors trade at varying valuations, but as you can see below, they average roughly nine times EBITDA.

Assuming SandRidge is successful in hitting its goal of$2 billion in cash flow by 2014 and debt of $4 billion in debt, if it were to trade at a similar EV/EBITDA ratio as competitors, it would have an EV of $19 billion. Subtracting $4 billion in debt, $1 billion in alternative financing, and $1 billion in preferred stock, the company’s equity will be worth $13 billion, four times its current value!

This is obviously not without risks. A significant fall in oil prices or bad financial markets that keep SandRidge out of alternative financing markets could require the company to dilute shareholders. At this price, however, the risk-reward ratio is solid and definitely worth consideration.

Foolish bottom lineWhile I believe SandRidge provides a compelling opportunity, if you are looking for safer bets on oil and gas, The Motley Fool has created a new, special oil report, and you can download it today at no cost to you. In this report, Fool analysts cover three outstanding oil companies, including the stock Fool analyst David Lee Smith calls the "energy king." To get instant access to the names of the three oil stocks, click here -- it's free.

Labels:

Affliate Marketing

Stay-at-Home Dad: Profiting From Our Children

Wouldn’t it be nice if cash flowed both ways?

As I may have maxed out my credit cards while doing the children’s back to school shopping, I started a small tally in my head: how much have I spent on my kids?

Then, a thought entered my mind: "What could I get my offspring to do to make money for me?" They are still pretty young, so hard labor won't do. I need to be pretty creative.

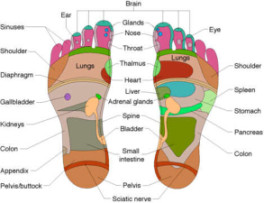

My youngest, who really enjoys giving my wife and me foot rubs for a buck, has amassed a small fortune. Maybe I could expand on that. Maybe I could send him to a school that teaches massage therapy, and after he has mastered his craft, we could book him appointments. How funny would it be to give him a portable heated table for his next birthday?

I don’t want to lose sight of what is really important, so only when he is done with his school homework will I allow him to finish memorizing his reflexology chart.

If his hands ever do fail him, I have another great idea how he could make some cash…for me. He has always had great phone skills, especially with older folks. I could set up a 976 phone number and create a call center for lonely old people. I could advertise the number in the back of "AARP Magazine" and "Good Housekeeping." My boy is so good, I don’t even need to make a script for him. He instinctively knows how to ask the right questions, gems such as, “How’s your back?” and “I wish that I were there with you. I would rub your bunions.”

This scheme would surely be a major success until his older brother haphazardly picked up the phone. Then I would need to have a scripted cheat sheet, or else we may have a lawsuit on our hands. “If I’m not in the will, I don’t love you.” Yes, another 30-second phone call that didn’t make any money.

My oldest is good with his hands, so maybe I could get him to start working at a local garage. He would be the perfect greasemonkey, and since he hasn’t hit a major growth spurt yet, they wouldn’t even need to put the cars up on lifts. He could just crawl under them and do some work. Maybe he could work with some repo men, although that may be too dangerous. If he gets tired of all this, I could have him make fake Gucci merchandise and then sell it downtown. Tourists will buy anything.

Until I can get these schemes up and running, it’s still up to me to pay for those school supplies, clothes, sports equipment and let's not forget that there are no free sports leagues. But please, make sure to keep on the lookout for 1-976-GRANDPA and 1-976-GRANDMA.

Source http://scarsdale.patch.com/

Then, a thought entered my mind: "What could I get my offspring to do to make money for me?" They are still pretty young, so hard labor won't do. I need to be pretty creative.

My youngest, who really enjoys giving my wife and me foot rubs for a buck, has amassed a small fortune. Maybe I could expand on that. Maybe I could send him to a school that teaches massage therapy, and after he has mastered his craft, we could book him appointments. How funny would it be to give him a portable heated table for his next birthday?

I don’t want to lose sight of what is really important, so only when he is done with his school homework will I allow him to finish memorizing his reflexology chart.

If his hands ever do fail him, I have another great idea how he could make some cash…for me. He has always had great phone skills, especially with older folks. I could set up a 976 phone number and create a call center for lonely old people. I could advertise the number in the back of "AARP Magazine" and "Good Housekeeping." My boy is so good, I don’t even need to make a script for him. He instinctively knows how to ask the right questions, gems such as, “How’s your back?” and “I wish that I were there with you. I would rub your bunions.”

This scheme would surely be a major success until his older brother haphazardly picked up the phone. Then I would need to have a scripted cheat sheet, or else we may have a lawsuit on our hands. “If I’m not in the will, I don’t love you.” Yes, another 30-second phone call that didn’t make any money.

My oldest is good with his hands, so maybe I could get him to start working at a local garage. He would be the perfect greasemonkey, and since he hasn’t hit a major growth spurt yet, they wouldn’t even need to put the cars up on lifts. He could just crawl under them and do some work. Maybe he could work with some repo men, although that may be too dangerous. If he gets tired of all this, I could have him make fake Gucci merchandise and then sell it downtown. Tourists will buy anything.

Until I can get these schemes up and running, it’s still up to me to pay for those school supplies, clothes, sports equipment and let's not forget that there are no free sports leagues. But please, make sure to keep on the lookout for 1-976-GRANDPA and 1-976-GRANDMA.

Source http://scarsdale.patch.com/

Labels:

Affliate Marketing

Wine country close to home

By HANK DANISZEWSKI, The London Free Press

It's a perfect summer day on the patio and the sun is warming my glass of Cabernet Merlot as it reflects the blue water before me and the expanse of vineyards on the shore.But this isn't Bordeaux or Tuscany or even the Niagara peninsula.

It's Essex County, where the north shore of Lake Erie has become home to a fast-growing cluster of wineries that are working hard to gain recognition with both wine connoisseurs and casual travelers looking for a new destination.

Colio, Pelee Island and D'Angelo are well-established Essex wineries familiar to consumers.

But in recent years the number of wineries in Canada's southernmost peninsula has soared to 15 with several more set to open soon.

Most of the new wineries are small family operations where the people behind the counter are often the ones who pruned the vines and bottled the wine.

Although Niagara has been Ontario's dominant wine region for decades, Essex was Canada's first wine-growing region with the first commercial vineyard established on Pelee Island in 1866.

Now that the old industry is undergoing a revival in Essex, the wine makers are reaching out to draw more visitors from London, Sarnia and even the Greater Toronto Area.

"Our growing seasons and soils are different from Niagara. We want people to come down here, bring their kids and enjoy our great wines and the region," said Tom O'Brien, head of the Southwestern Ontario Vintners Association and owner of Cooper's Hawk, the latest winery to open in the county.

The new Essex wineries are far more than small shops. Many feature elegant tasting rooms, tours, indoor and outdoor venues for weddings and other events, playgrounds, ponds, patios and picnic grounds.

"You can't make money just selling wine. You have to be a destination. Making wine is fairly easy. Selling is the hard part," O'Brien said.

The south coast of Essex and Chatham Kent is on the same latitude as Europe's finest wine regions and all the extra heat and sun allow for an earlier harvest and give the wines a unique flavour.

From the London area, Highway #3, also known as Talbot Trail, provides a quiet, scenic route directly to Essex wineries with Smith and Wilson Estate Wines along the way near Blenhiem.

The Essex county roads are marked with Wine Route signs to help guide visitors. On Thursday the annual Shores of Erie International Wine Festival kicks off at Fort Malden in Amherstburg. The four-day festival features 18 wineries and 30 restaurants. Monthly bike tours of the wineries are available through the summer and fall through windsoreats.com. When you're not sipping wine Essex County boasts some great beaches, a bevy of roadside fruit and vegetable stands, the natural beauty of Point Pelee and Pelee Island and local attractions such as Colasanti's Tropical Gardens.

The county is dotted with more than a dozen B&Bs and historic inns such as Seacliffe Inn in Leamington and Kings Hotel Inn in Kingsville.

If you want a change of pace after a day in the country, Caesar's Windsor is just a short drive away offering Las Vegas gaming and glamour, world-class entertainment and sumptuous dining at Nero's Steakhouse.

The combination of attractions boost the confidence of people like Fabio Muscedere, who gave up a corporate career to help establish his family's winery.

He said Essex County has the right climate and the tradition to become a major wine-producing region and he believes it will continue to grow.

"It's coming along. If this region hits 25 wineries, that's a good number. Then people would say 'I've got to go check that out.'"

Labels:

Affliate Marketing

Q&A: Harit Nagpal, MD & CEO, Tata Sky

Harit Nagpal, 50, must be a glutton for punishment. Late last year the former director marketing for Vodafone Group, UK, relocated to India to run a loss-making direct-to-home TV operator. As managing director and CEO of Tata-Sky, he has the unenviable task of figuring out how to make money in a very competitive market with six players, low average revenues per user (ARPU) and a regulatory tangle that foxes the best of minds. At 7 million out of the 35 million subscriber DTH market, Tata-Sky is not in a bad place. But it is the “how to achieve profits” question that is dogging the company. Over the five years since its launch, this 80:20 joint venture between the Tata Group and Star Group has sunk in Rs 5,000 crore or just over a billion dollars into the Indian DTH market. There are, however, no signs of a break even. One week before he completed a year at Tata-Sky, Vanita Kohli-Khandekar had a long chat with Nagpal on how he views this industry. Edited excerpts:

From telecom to media what are the big differences?

I am not feeling out of place. I have spent the early years of telecom, in telecom; saw the first five million telecom subs. This [the DTH business] reminds me of the early years of telecom. It has come farther in five years than telecom did. It has all the problems that go with scaling up. Both [telecom and DTH] are technology services, consumed by a fragmented and large customer base. There are elements of technology in the service and distribution. It is a new business so one has to understand the dynamics. But I have been part of nascent businesses earlier at Lakme, Pepsi and Marico. So the operations are easy to handle because all the variables are in our control.The problem is that after opening up this sector, growth is being held back. The ministry of information and broadcasting (MIB) has allowed 700 channels into India, but my satellite capacity is only up to 300 channels. I am ready to buy that capacity, but am not getting that meeting with ISRO for a year. [It is mandatory for DTH operators to buy satellite capacity from the Indian Space Research Organisation. Capacity on foreign satellites can be bought only through ISRO. ISRO incidentally does not have enough KU-band capacity to meet the demands of the Indian market]. I have lost four satellites in the process [satellites that wanted to sell KU-band capacity over India and have moved on to other markets after waiting for ISRO]. And I am still stuck providing 300 channels. Just give me the freedom to go to the satellite operator that has bandwidth.

Why not lobby for a change in policy, there are six of you?

Who should we lobby with? Is there one person willing to or capable of taking a decision? We are meeting people constantly, but is there hope. I am not so sure. It will take longer. Tata-Sky has already put in Rs 5,000 crore. It will probably put in another Rs 5,000 crore over the next few years before we get a rupee. Break even could take 10 years. You could cut it down to six-seven years by giving a tax-holiday or tax breaks.

The bureaucratic hurdles around this business are very large. For example, this industry pays 30 per cent tax on revenues. Show me another fledgling industry paying those kind of taxes? DTH came in because of the under-declaration by cable operators. You are putting a 30 cent tax from day one on a sector from which you [the government] are making more money than cable. What is the intention of the government? Is it to allow addressable digitisation, get taxes, ensure broadcasters get a fair share and customers get interactivity? If that is the intention then either provide the infrastructure or let me buy it. Instead of focusing on creating infrastructural support we are focusing on the wrong things. This industry will make money for everyone in the long term. The government will get more in taxes, broadcasters in pay revenues and DTH operators in revenues.

There have been many product changes to Tata-Sky in the last six months. What is the logic?

We have done a lot of work to make the product as customer-friendly as possible. We are not selling metals but entertainment, so why were our packages called gold and silver. We have recreated our packages to make them easy to use. So if you say “I am in the mood for Hindi movies” you know what package to buy. There are packages for English entertainment, Hindi entertainment and so on.

That must be a nightmare at the backend.

It is complicated at the IT and installation level to create and execute.

Your comment on costs and revenues, both are problem areas for most DTH operators.

In the long term, the cost structures of the leading DTH operators tend to converge. I don’t see an opportunity for huge cost reductions in this industry. Don’t see mergers and acquisitions happening as easily as they did in telecom. Any DTH operator, who buys another operator, has to re-point all the subscribers to his satellite. Plus you have to re-price the new consumers and the chances are you will lose the consumer.

Source http://www.business-standard.com/

From telecom to media what are the big differences?

I am not feeling out of place. I have spent the early years of telecom, in telecom; saw the first five million telecom subs. This [the DTH business] reminds me of the early years of telecom. It has come farther in five years than telecom did. It has all the problems that go with scaling up. Both [telecom and DTH] are technology services, consumed by a fragmented and large customer base. There are elements of technology in the service and distribution. It is a new business so one has to understand the dynamics. But I have been part of nascent businesses earlier at Lakme, Pepsi and Marico. So the operations are easy to handle because all the variables are in our control.The problem is that after opening up this sector, growth is being held back. The ministry of information and broadcasting (MIB) has allowed 700 channels into India, but my satellite capacity is only up to 300 channels. I am ready to buy that capacity, but am not getting that meeting with ISRO for a year. [It is mandatory for DTH operators to buy satellite capacity from the Indian Space Research Organisation. Capacity on foreign satellites can be bought only through ISRO. ISRO incidentally does not have enough KU-band capacity to meet the demands of the Indian market]. I have lost four satellites in the process [satellites that wanted to sell KU-band capacity over India and have moved on to other markets after waiting for ISRO]. And I am still stuck providing 300 channels. Just give me the freedom to go to the satellite operator that has bandwidth.

Why not lobby for a change in policy, there are six of you?

Who should we lobby with? Is there one person willing to or capable of taking a decision? We are meeting people constantly, but is there hope. I am not so sure. It will take longer. Tata-Sky has already put in Rs 5,000 crore. It will probably put in another Rs 5,000 crore over the next few years before we get a rupee. Break even could take 10 years. You could cut it down to six-seven years by giving a tax-holiday or tax breaks.

The bureaucratic hurdles around this business are very large. For example, this industry pays 30 per cent tax on revenues. Show me another fledgling industry paying those kind of taxes? DTH came in because of the under-declaration by cable operators. You are putting a 30 cent tax from day one on a sector from which you [the government] are making more money than cable. What is the intention of the government? Is it to allow addressable digitisation, get taxes, ensure broadcasters get a fair share and customers get interactivity? If that is the intention then either provide the infrastructure or let me buy it. Instead of focusing on creating infrastructural support we are focusing on the wrong things. This industry will make money for everyone in the long term. The government will get more in taxes, broadcasters in pay revenues and DTH operators in revenues.

There have been many product changes to Tata-Sky in the last six months. What is the logic?

We have done a lot of work to make the product as customer-friendly as possible. We are not selling metals but entertainment, so why were our packages called gold and silver. We have recreated our packages to make them easy to use. So if you say “I am in the mood for Hindi movies” you know what package to buy. There are packages for English entertainment, Hindi entertainment and so on.

That must be a nightmare at the backend.

It is complicated at the IT and installation level to create and execute.

Your comment on costs and revenues, both are problem areas for most DTH operators.

In the long term, the cost structures of the leading DTH operators tend to converge. I don’t see an opportunity for huge cost reductions in this industry. Don’t see mergers and acquisitions happening as easily as they did in telecom. Any DTH operator, who buys another operator, has to re-point all the subscribers to his satellite. Plus you have to re-price the new consumers and the chances are you will lose the consumer.

Source http://www.business-standard.com/

Labels:

Affliate Marketing

Ulrika Jonsson: ‘I’m passionate about human relationships...I’ve had quite a few myself’

As she launches her rather surprisingly good first novel, TV star Ulrika Jonsson talks to Hannah Stephenson about having four children by four different fathers

Fans of Ulrika Jonsson might expect her debut novel, The Importance Of Being Myrtle, to be a steamy ‘bonkbuster', featuring at least one lurid affair, a string of failed marriages and a handful of celebrity misdemeanours.

But then, as Jonsson explains at a hotel in Henley, Oxon, near her country home, she didn't want her first book to be an extension of her own life.

“People would be expecting me to write about the world of television or showbiz with lots of sex, drugs and rock ‘n' roll. That would be too predictable. I wanted to stretch myself.”

Today, looking painfully thin, which she puts down to her depression due to a four-year battle with a chronic back condition, Jonsson insists she's close to the weight she's supposed to be.

“There was talk thatI had anorexia, which I have never had and will never have because I love food too much. I've had a debilitating problem and the past year was particularly bad, when I became depressed and didn't eat.

“My condition won't be cured but it's better than it was. I've started swimming, that strengthens the muscles.”

She can't run or sit down for long periods but epidural and cortisone injections have given her some respite.

“I just have to live with it, as much as possible. The days when I was immobile have made me more determined to enjoy the days I'm mobile.”

One consequence of her degenerative disc is that she has had to write some of her novel standing up but it doesn't seem to have affected the result.

Unlike so many celeb books, The Importance Of Being Myrtle is notghost-written and is a surprisingly good read about a drab, dowdy 58-year-old woman whose life is thrown into turmoil when her husband dies suddenly. Hardly autobiographical, then, from the ex-weathergirl who was once cruelly nicknamed ‘4X4' (four children by four different men). She was tabloid fodder for years because of her roller -coaster private life, including a string of ill-fated marriages, a beating from one-time boyfriend Stan Collymore, an affair with Sven-Goran Eriksson and a 2002 autobiography in which she alleged she had been raped by an unnamed TV presenter (whom she has never identified).

The debut novel is less headline-grabbing. As the story unfolds, it emerges that for 40 years Myrtle, the put-upon heroine, was trapped in a loveless marriage by a control freak. There's no physical violence but the emotional abuse is palpable.

“I'm very passionate about human relationships, having experienced quite a few myself,” Jonsson (44) says with a smile. “I've been in relationships where someone's trying to control you and suppress your colourful character. For some men, I guess having a loud, outspoken partner is not for them.”

Jonsson and her third husband, advertising executive Brian Monet, and her four children aged between 16 and three, have recently moved into the five-bedroom home they have spent the last 18 months building and, while she's currently starring in the new Shooting Stars series, her focus is on her home life, rather than TV.

“Everybody has this weird view of what my family must be like, that there are four fathers standing at the

door and the kids are colour-coded to go with each one. But I live with one of the fathers, another is completely absent, we see my older son's dad every day and daughter Martha's dad every second weekend. We are a family. I don't think my children think it's weird, odd or disjointed. There is no feeling of animosity. I've not even had a great deal of issue in organising the family. We work hard at compromising, giving and taking.”

She's dispensed with her nanny, preferring to split the childcare with Monet who takes over when she has TV commitments.

Reuniting with Vic Reeves and Bob Mortimer was like slipping back into a pair of comfortable shoes. “I've known the boys for 18 years now and nothing much has changed. We all look a bit older. It's such an honour to sit there and get paid to laugh.”

However, she seems disillusioned with the world of TV which, she says, is now run by accountants who just want to make shows which make money. Jonsson wants to do more serious TV, such as documentaries, rather than what her pal Claudia Winkleman calls ‘shiny floor TV'.

“Shiny floor TV is the stuff that pays. I wanted to make a documentary about old people, not a game show where everyone gets their t*ts out. Everything's so commercial. I did Big Brother because it was big money. Yes, I’ve regrets not being able to do more serious stuff.”

Born in Sweden, Jonsson was eight when her mother left her to go and live with her new boyfriend. Jonsson was put in the care of her father but in reality she looked after him. At 12, she was reunited with her mother who had moved to the UK but it left Jonsson with deep feelings of anxiety. “I've always had a fear of being left. Then my father died when I was 27 and it made it hard for me to relax, as I was always anticipating the worst.”

While she doesn't resent her mother's desertion, she still can’t understand how she could have left her child. “As a mother, there’s no way in the world that a man would ever mean more to me than my child. I've tried to talk to my mother about it, but she won't discuss it.”

And she bristles slightly at the suggestion her taste in men hasn't always been the best: “Why is it about my choice? If a man lets me down, how is that my choice? A breakdown of any relationship has got to involve responsibility from both sides.

“I don't think my experiences are so different to those of other men and women. Mine have been grossly exaggerated because they've been in the public eye. I've been a tabloid dream for the past 23 years, less so nowadays and I have to say that's really quite lovely.”

Jonsson is one of a string of celebrities taking legal action against the News Of The World over alleged phone hacking. She says: “Whether you think people in showbiz or politicians are fair game, everybody is entitled to some aspect of private life.”

Jonsson recently told of her distress when she was contacted by police about being allegedly monitored.

“It's shocking but not surprising. Over the years the tabloids have done worse things, whether they're following you, turning up at your father's funeral, dressing up as doctors at the special care baby unit when your daughter’s fighting for her life ... there's not a level to which they won't stoop.”

Today, she doesn't have many showbiz friends, just a close circle of people she can trust. She hopes to write more books..

“I think I'd rather be out of the spotlight,” she says.

A novel career may be just the ticket.

The Importance Of Being Myrtle, Ulrika Jonsson, Michael Joseph, £6.99

Media, marriages and being a mum

Fans of Ulrika Jonsson might expect her debut novel, The Importance Of Being Myrtle, to be a steamy ‘bonkbuster', featuring at least one lurid affair, a string of failed marriages and a handful of celebrity misdemeanours.

But then, as Jonsson explains at a hotel in Henley, Oxon, near her country home, she didn't want her first book to be an extension of her own life.

“People would be expecting me to write about the world of television or showbiz with lots of sex, drugs and rock ‘n' roll. That would be too predictable. I wanted to stretch myself.”

Today, looking painfully thin, which she puts down to her depression due to a four-year battle with a chronic back condition, Jonsson insists she's close to the weight she's supposed to be.

“There was talk thatI had anorexia, which I have never had and will never have because I love food too much. I've had a debilitating problem and the past year was particularly bad, when I became depressed and didn't eat.

“My condition won't be cured but it's better than it was. I've started swimming, that strengthens the muscles.”

She can't run or sit down for long periods but epidural and cortisone injections have given her some respite.

“I just have to live with it, as much as possible. The days when I was immobile have made me more determined to enjoy the days I'm mobile.”

One consequence of her degenerative disc is that she has had to write some of her novel standing up but it doesn't seem to have affected the result.

Unlike so many celeb books, The Importance Of Being Myrtle is notghost-written and is a surprisingly good read about a drab, dowdy 58-year-old woman whose life is thrown into turmoil when her husband dies suddenly. Hardly autobiographical, then, from the ex-weathergirl who was once cruelly nicknamed ‘4X4' (four children by four different men). She was tabloid fodder for years because of her roller -coaster private life, including a string of ill-fated marriages, a beating from one-time boyfriend Stan Collymore, an affair with Sven-Goran Eriksson and a 2002 autobiography in which she alleged she had been raped by an unnamed TV presenter (whom she has never identified).

The debut novel is less headline-grabbing. As the story unfolds, it emerges that for 40 years Myrtle, the put-upon heroine, was trapped in a loveless marriage by a control freak. There's no physical violence but the emotional abuse is palpable.

“I'm very passionate about human relationships, having experienced quite a few myself,” Jonsson (44) says with a smile. “I've been in relationships where someone's trying to control you and suppress your colourful character. For some men, I guess having a loud, outspoken partner is not for them.”

Jonsson and her third husband, advertising executive Brian Monet, and her four children aged between 16 and three, have recently moved into the five-bedroom home they have spent the last 18 months building and, while she's currently starring in the new Shooting Stars series, her focus is on her home life, rather than TV.

“Everybody has this weird view of what my family must be like, that there are four fathers standing at the

door and the kids are colour-coded to go with each one. But I live with one of the fathers, another is completely absent, we see my older son's dad every day and daughter Martha's dad every second weekend. We are a family. I don't think my children think it's weird, odd or disjointed. There is no feeling of animosity. I've not even had a great deal of issue in organising the family. We work hard at compromising, giving and taking.”

She's dispensed with her nanny, preferring to split the childcare with Monet who takes over when she has TV commitments.

Reuniting with Vic Reeves and Bob Mortimer was like slipping back into a pair of comfortable shoes. “I've known the boys for 18 years now and nothing much has changed. We all look a bit older. It's such an honour to sit there and get paid to laugh.”

However, she seems disillusioned with the world of TV which, she says, is now run by accountants who just want to make shows which make money. Jonsson wants to do more serious TV, such as documentaries, rather than what her pal Claudia Winkleman calls ‘shiny floor TV'.

“Shiny floor TV is the stuff that pays. I wanted to make a documentary about old people, not a game show where everyone gets their t*ts out. Everything's so commercial. I did Big Brother because it was big money. Yes, I’ve regrets not being able to do more serious stuff.”

Born in Sweden, Jonsson was eight when her mother left her to go and live with her new boyfriend. Jonsson was put in the care of her father but in reality she looked after him. At 12, she was reunited with her mother who had moved to the UK but it left Jonsson with deep feelings of anxiety. “I've always had a fear of being left. Then my father died when I was 27 and it made it hard for me to relax, as I was always anticipating the worst.”

While she doesn't resent her mother's desertion, she still can’t understand how she could have left her child. “As a mother, there’s no way in the world that a man would ever mean more to me than my child. I've tried to talk to my mother about it, but she won't discuss it.”

And she bristles slightly at the suggestion her taste in men hasn't always been the best: “Why is it about my choice? If a man lets me down, how is that my choice? A breakdown of any relationship has got to involve responsibility from both sides.

“I don't think my experiences are so different to those of other men and women. Mine have been grossly exaggerated because they've been in the public eye. I've been a tabloid dream for the past 23 years, less so nowadays and I have to say that's really quite lovely.”

Jonsson is one of a string of celebrities taking legal action against the News Of The World over alleged phone hacking. She says: “Whether you think people in showbiz or politicians are fair game, everybody is entitled to some aspect of private life.”

Jonsson recently told of her distress when she was contacted by police about being allegedly monitored.

“It's shocking but not surprising. Over the years the tabloids have done worse things, whether they're following you, turning up at your father's funeral, dressing up as doctors at the special care baby unit when your daughter’s fighting for her life ... there's not a level to which they won't stoop.”

Today, she doesn't have many showbiz friends, just a close circle of people she can trust. She hopes to write more books..

“I think I'd rather be out of the spotlight,” she says.

A novel career may be just the ticket.

The Importance Of Being Myrtle, Ulrika Jonsson, Michael Joseph, £6.99

Media, marriages and being a mum

- After a brief stint as a secretary, she began her TV career on TV-am in 1989 where she worked as a weather presenter. Her name was linked to Prince Andrew.

- In the Nineties, she moved to Saturday night TV with hit show Gladiators. She also became a team captain on Shooting Stars

- In 2009, Ulrika won Celebrity Big Brother, despite having been repeatedly nominated for eviction by her fellow celebs

- She has a son Cameron from her first marriage to a TV cameraman, a daughter Bo from her relationship with Markus Kempen, a daughter Martha from her marriage to Lance Gerrard-Wright and son Malcolm from her current marriage to Brian Monet.

- Source http://www.belfasttelegraph.co.uk/

Labels:

Affliate Marketing

Regions takes Bolze home

by DEREK HODGES

SEVIERVILLE — A dozen or so times Walt Winchester has stood alone on the steps of the Sevier County Courthouse announcing the auction of Ponzi schemer Dennis Bolze’s old home was canceled. Thursday was different: He finally had an actual sale, a crowd and even a buyer.

Still, it was just Winchester’s client, Regions Bank, that ended up with the deed after the sale, with a bid of $1.8 million, far less than the home is valued at and an even smaller number than was bid during another auction in May.

When that deal fell through, Winchester, the substitute trustee hired in early 2009 to represent the financial institution, sent out notice the home was finally going to be foreclosed on, nearly three years after Bolze fled the county and quit paying. Winchester announced Regions’ bid to the crowd, apparently composed mostly of curious onlookers, and waited to hear a higher offer. He repeated the number several times and asked for another one, to the point where he almost seemed to be pleading.

“I will sell this property quickly if there aren’t any other bids,” he said.

A bank buying a property at foreclosure auction isn’t unusual; in fact, it’s standard practice. Still, it seemed a bit unusual for the Bolze home, given the interest in the property and the bid far below the likely value, of which estimates range from $4 million to more than $10 million.

“The auction of the Bolze property went as we expected,” Regions Bank spokesman Mel Campbell said. “We have already

heard from some parties interested in it, and we look forward to having a contact on it in the near future.”

It seems those in the crowd who were considering a buy were put off by some issues related to the property. There are a couple junior liens that haven’t been resolved, the bank has allowed $60,000-$65,000 in back taxes accrue according to Winchester and bids were required to be in $25,000 increments. It appears the pile of taxes may have accumulated because one of Bolze’s shell companies still technically owned the home until Thursday.

“There are too many issues, legal and otherwise, with this property,” said Buddy McLean, who conceded the property is worth far more than the amount bid but said no one wants to deal with the hassles that come along with Bolze’s home.

McLean certainly had an interest in the property. He owns The Lodge at Buckberry Creek, an upscale inn and restaurant directly adjacent to the 835 Campbell Lead Road tract Bolze owned. Beyond that, he was actually one of the developers who offered all the land Bolze built on as Highgate Estates before the jailed scammer bought the whole subdivision for his mountainside mansion.

McLean said he wasn’t surprised by the way things went and never expected to make a bid, but was just there to see what happened. So too was Gatlinburg Vice Mayor Jerry Hays, who came out in hopes of seeing an end to a story that has tied negative headlines to his city.

“It really doesn’t affect the city that much, but the publicity is tough. Every time there’s a story about this, it reminds people Dennis Bolze lived in Gatlinburg,” Hays said. “This needs to be resolved.”

Like McLean, Hays wasn’t at all surprised the home stayed with the bank, which held the main note on the property long before it bought the deed.

“Given the economy, it’s not really a surprise at all,” he said. “People are scared to bid on anything these days.”

Jim Hedrick, a principal in Fee Hedrick Family Entertainment, said he had no qualms about making a purchase Thursday morning until Winchester divulged the situation, including the outstanding taxes and the bank’s bid.

“I did not know the bank was going to have an opening bid of that amount,” Hedrick said. “I was hoping to get in on a fire sale today. I had hoped to get a deal and flip this property in a few months.

“The amount of back taxes was a bit of a surprise to me. On top of that, you’ve got the fact that they had a minimum $25,000 bid. Add all that to the equation and you’re near $1.9 million with the first bid. I was thinking something more around $1 million, but I would have gone to $1.5 million. They beat me by $300,000.”

Though he didn’t get the chance to resell the property that he hoped for, Hedrick said he believes the bank will likely find success in its effort to do just that.

“Will they find a buyer for about $2 million? Potentially,” he said. “In the meantime, they’ve got to keep that on their books and continue to pay for the security guards and all that.”

McLean agreed the property will sell, though he, like Hedrick, had an eye on the dangers of it remaining in limbo.

“I think they will unload it because it’s a beautiful piece of property, but if it goes a lot longer it’s going to need some serious maintenance,” he said.

The home has already been sitting empty since Bolze abandoned it and his family here in December 2008, as his Ponzi scheme was falling apart around him. During recent open houses the property was already showing some of the wear of sitting empty, with a broken window held together by packing tape and weed vines overtaking the once well-manicured gardens.

Sale of the property has been delayed multiple times, not just because of the May deal that fell through when the would-be buyers failed to come forward with money to cover their $1.93 million bid. The home has been part of the legal fight in a bankruptcy proceeding dividing Bolze’s assets, with his victims and Regions fighting over who should get funds from the sale. In the end, after arguing any cash paid would likely be far less than the $5.1 million or so in liens against the home, Regions won the right to sell and claim the money for itself and the junior lien holders. Those lesser loans were from two couples who invested with Bolze, including one local pair.

dhodges@themountainpress.com

SEVIERVILLE — A dozen or so times Walt Winchester has stood alone on the steps of the Sevier County Courthouse announcing the auction of Ponzi schemer Dennis Bolze’s old home was canceled. Thursday was different: He finally had an actual sale, a crowd and even a buyer.

Still, it was just Winchester’s client, Regions Bank, that ended up with the deed after the sale, with a bid of $1.8 million, far less than the home is valued at and an even smaller number than was bid during another auction in May.

When that deal fell through, Winchester, the substitute trustee hired in early 2009 to represent the financial institution, sent out notice the home was finally going to be foreclosed on, nearly three years after Bolze fled the county and quit paying. Winchester announced Regions’ bid to the crowd, apparently composed mostly of curious onlookers, and waited to hear a higher offer. He repeated the number several times and asked for another one, to the point where he almost seemed to be pleading.

“I will sell this property quickly if there aren’t any other bids,” he said.

A bank buying a property at foreclosure auction isn’t unusual; in fact, it’s standard practice. Still, it seemed a bit unusual for the Bolze home, given the interest in the property and the bid far below the likely value, of which estimates range from $4 million to more than $10 million.

“The auction of the Bolze property went as we expected,” Regions Bank spokesman Mel Campbell said. “We have already

heard from some parties interested in it, and we look forward to having a contact on it in the near future.”

It seems those in the crowd who were considering a buy were put off by some issues related to the property. There are a couple junior liens that haven’t been resolved, the bank has allowed $60,000-$65,000 in back taxes accrue according to Winchester and bids were required to be in $25,000 increments. It appears the pile of taxes may have accumulated because one of Bolze’s shell companies still technically owned the home until Thursday.

“There are too many issues, legal and otherwise, with this property,” said Buddy McLean, who conceded the property is worth far more than the amount bid but said no one wants to deal with the hassles that come along with Bolze’s home.

McLean certainly had an interest in the property. He owns The Lodge at Buckberry Creek, an upscale inn and restaurant directly adjacent to the 835 Campbell Lead Road tract Bolze owned. Beyond that, he was actually one of the developers who offered all the land Bolze built on as Highgate Estates before the jailed scammer bought the whole subdivision for his mountainside mansion.

McLean said he wasn’t surprised by the way things went and never expected to make a bid, but was just there to see what happened. So too was Gatlinburg Vice Mayor Jerry Hays, who came out in hopes of seeing an end to a story that has tied negative headlines to his city.

“It really doesn’t affect the city that much, but the publicity is tough. Every time there’s a story about this, it reminds people Dennis Bolze lived in Gatlinburg,” Hays said. “This needs to be resolved.”

Like McLean, Hays wasn’t at all surprised the home stayed with the bank, which held the main note on the property long before it bought the deed.

“Given the economy, it’s not really a surprise at all,” he said. “People are scared to bid on anything these days.”

Jim Hedrick, a principal in Fee Hedrick Family Entertainment, said he had no qualms about making a purchase Thursday morning until Winchester divulged the situation, including the outstanding taxes and the bank’s bid.

“I did not know the bank was going to have an opening bid of that amount,” Hedrick said. “I was hoping to get in on a fire sale today. I had hoped to get a deal and flip this property in a few months.

“The amount of back taxes was a bit of a surprise to me. On top of that, you’ve got the fact that they had a minimum $25,000 bid. Add all that to the equation and you’re near $1.9 million with the first bid. I was thinking something more around $1 million, but I would have gone to $1.5 million. They beat me by $300,000.”

Though he didn’t get the chance to resell the property that he hoped for, Hedrick said he believes the bank will likely find success in its effort to do just that.

“Will they find a buyer for about $2 million? Potentially,” he said. “In the meantime, they’ve got to keep that on their books and continue to pay for the security guards and all that.”

McLean agreed the property will sell, though he, like Hedrick, had an eye on the dangers of it remaining in limbo.

“I think they will unload it because it’s a beautiful piece of property, but if it goes a lot longer it’s going to need some serious maintenance,” he said.

The home has already been sitting empty since Bolze abandoned it and his family here in December 2008, as his Ponzi scheme was falling apart around him. During recent open houses the property was already showing some of the wear of sitting empty, with a broken window held together by packing tape and weed vines overtaking the once well-manicured gardens.

Sale of the property has been delayed multiple times, not just because of the May deal that fell through when the would-be buyers failed to come forward with money to cover their $1.93 million bid. The home has been part of the legal fight in a bankruptcy proceeding dividing Bolze’s assets, with his victims and Regions fighting over who should get funds from the sale. In the end, after arguing any cash paid would likely be far less than the $5.1 million or so in liens against the home, Regions won the right to sell and claim the money for itself and the junior lien holders. Those lesser loans were from two couples who invested with Bolze, including one local pair.

dhodges@themountainpress.com

Labels:

Affliate Marketing

Can Digital Art Make Money?

It would be easy to make the mistake of defining new media art as an entirely different beast from "old media" formats like painting and sculpture. After all, digital file-based works are, in their basic state, infinitely replicable, able to be seen by any audience on earth at any time, and without any physical form. But what's so intriguing about the burgeoning field of new media art is that it challenges the status quo of traditional artistic media, while at the same time adopting some of the same norms to become viable in the contemporary art market. The demand and collector base for new media art is small as of yet, but artists still must find ways to both control the dissemination of their work and make it saleable. But the paradox of new media art remains — how is it possible to sell something that it is impossible to own?

The strategies that are developing to monetize new media art are surprising mainly in their familiarity. Among them are creating an artificial scarcity for the files themselves, adopting a patronage system in which the collector is inextricably associated with the work, and turning the digital files into physical objects more immediately accessible to a traditional collector base.

A flash point in the commodification of new media art occurred earlier this year at one of New York's most recognizable venues for commercial art work — the Armory Fair. Lauren Cornell, director of new media-oriented online publication Rhizome, set up a booth selling digital work, as displayed on a 27-inch iMac screen. Hrag Vartanian, editor of art blog Hyperallergic, interviewed Cornell about the challenges of selling such non-traditional pieces of art (the full video of the interview can be seen here) [Full disclosure: I was until recently staff writer at Hyperallergic, and was present when Hrag first approached Cornell about the interview]. Pointing out Sara Ludy's "City Inverse" on the screen, Cornell notes that, "you can sell digital work in different ways but in Sara's case we're going to take it offline for the collector so they can just have it locally." This means that Ludy's GIF file would no longer be hosted live on the artist's Web site in an "official" capacity, and the collector would be able to possess the file on their own drive space, much like a painting going in to private hands. The work would be inaccessible — that is, if other artists, writers, and bloggers had not already re-published Ludy's file elsewhere, disrupting the possibility of true unique ownership. Ludy's work has already disseminated through the Internet, and is likely possessed locally (on home hard drives) by more than a few viewers.

Cornell's statement touched off a heated comment thread and dialogue on Hyperallergic and off. The reason for the controversy is that being "online" is often seen as integral to new media work. The question becomes, if a digital file is not live on the Internet, is it still a work of Internet art? Artists Jeremiah Johnson (Nullsleep) and No Carrier embarked on a new project in response to Cornell's statement. The mission of the resulting Web site, 0-DAY, is to keep works of Internet art online at any costs. With a lo-fi hacker aesthetic and a punchy attitude, the people behind 0-DAY are the free-data pirates of the new media world.

Respected GIF artist and omnipresent Internet commentator Tom Moody wrote, "No director of a new media website should be promoting work in those terms." Ludy responded, "It was my decision to take the GIFs offline, not [Cornell's]." Taking a work wholly offline, or turning it into a consumable object editioned in a limited quantity, imposes a false scarcity on the art that works much like the limited edition of a photographic print would — a decreased supply leads to an increased demand. Other artists, however, are pursuing strategies that allow the work to remain online while it is still collected and owned by an individual.

Source http://www.artinfo.com/

The strategies that are developing to monetize new media art are surprising mainly in their familiarity. Among them are creating an artificial scarcity for the files themselves, adopting a patronage system in which the collector is inextricably associated with the work, and turning the digital files into physical objects more immediately accessible to a traditional collector base.

A flash point in the commodification of new media art occurred earlier this year at one of New York's most recognizable venues for commercial art work — the Armory Fair. Lauren Cornell, director of new media-oriented online publication Rhizome, set up a booth selling digital work, as displayed on a 27-inch iMac screen. Hrag Vartanian, editor of art blog Hyperallergic, interviewed Cornell about the challenges of selling such non-traditional pieces of art (the full video of the interview can be seen here) [Full disclosure: I was until recently staff writer at Hyperallergic, and was present when Hrag first approached Cornell about the interview]. Pointing out Sara Ludy's "City Inverse" on the screen, Cornell notes that, "you can sell digital work in different ways but in Sara's case we're going to take it offline for the collector so they can just have it locally." This means that Ludy's GIF file would no longer be hosted live on the artist's Web site in an "official" capacity, and the collector would be able to possess the file on their own drive space, much like a painting going in to private hands. The work would be inaccessible — that is, if other artists, writers, and bloggers had not already re-published Ludy's file elsewhere, disrupting the possibility of true unique ownership. Ludy's work has already disseminated through the Internet, and is likely possessed locally (on home hard drives) by more than a few viewers.

Cornell's statement touched off a heated comment thread and dialogue on Hyperallergic and off. The reason for the controversy is that being "online" is often seen as integral to new media work. The question becomes, if a digital file is not live on the Internet, is it still a work of Internet art? Artists Jeremiah Johnson (Nullsleep) and No Carrier embarked on a new project in response to Cornell's statement. The mission of the resulting Web site, 0-DAY, is to keep works of Internet art online at any costs. With a lo-fi hacker aesthetic and a punchy attitude, the people behind 0-DAY are the free-data pirates of the new media world.

Respected GIF artist and omnipresent Internet commentator Tom Moody wrote, "No director of a new media website should be promoting work in those terms." Ludy responded, "It was my decision to take the GIFs offline, not [Cornell's]." Taking a work wholly offline, or turning it into a consumable object editioned in a limited quantity, imposes a false scarcity on the art that works much like the limited edition of a photographic print would — a decreased supply leads to an increased demand. Other artists, however, are pursuing strategies that allow the work to remain online while it is still collected and owned by an individual.

Source http://www.artinfo.com/

Labels:

Affliate Marketing

Neugebauer visits VA hospital, state home during Big Spring stop

By Greg Kendall-Ball

BIG SPRING — U.S. Rep. Randy Neugebauer enjoyed two things about Thursday's lunch at the Texas State Veterans Home — chatting with some "real American heroes" and eating real West Texas barbecue.

"In Washington, I don't know what it is they call barbecue, but it's nothing like the real thing," he told his tablemates. "Whenever I come back home, I always try to get my fill of brisket."

Neugebauer, R-Lubbock, was here to visit two veterans facilities along with U.S. Reps. Mike Conaway, R-Midland, and Jeff Miller, R-Florida, chairman of the House Veterans Affairs Committee.

The morning was spent at the VA Medical Center, but at noon, Neugebauer headed to the Lamun-Lusk-Sanchez Texas State Veterans Home.

Following a brief meeting with the state home leadership, Neugebauer and his staff took their place in line behind about 30 veterans. About 150 men and women currently live at the home.

After loading up his plate with brisket, beans and potatoes, Neugebauer took a seat at a table with three veterans.

Conversation topics ranged from barbecue to budget cuts.

Neugebauer said he agreed with comments Miller made earlier at the VA Medical Center that veterans programs should be taken off the table as much as possible when Congress considers funding cuts. The VA is the second-largest department within the federal government, with more than 300,000 employees and an annual budget of nearly $100 billion. Only the Department of Defense is larger.

"I think what the chairman said is right: to the greatest extent possible, we're trying to preserve that funding," Neugebauer said.

"It's not just how much money you spend, many times it's how you spend it. What we want to do is take advantage of technology and new techniques. We want to make sure we have good, relevant, available health care for our veterans. We may deliver it in different ways, but the bottom line is we make sure we deliver it."

Neugebauer said he also recognized the need to address spending within the agency.

"We owe the American taxpayers the responsibility of delivering (veterans' health care) in a responsible, cost-effective way," he said.

It will be challenging, he said, especially since the current budget calls for "unsustainable" borrowing of 42 cents of every dollar spent.

"Families can't do that, businesses can't do that, and our government cannot continue to do that. What we're going to have to do is prioritize how we spend that money in the future, and certainly our veterans are going to be one of our priorities," he said.

Walter Durham, 83, a World War II veteran, has lived at the veterans home for about a year. He said he draws a little more than $1,200 a month in Social Security and VA benefits, and if cuts were made to the VA budget, he would have significant financial worries.

"If it wasn't for the VA, I couldn't live in this home, afford the medications I need, or get the care I need here. And I got nowhere else to go," he said.

"The government promised us, when we came out of the service, that they'd take care of us when we needed it. Veteran funding should be 100 percent off-limits," he said.

Bob Kerr, administrator of the home, said the funding picture may be cloudy, but the ongoing need for veterans services is clear.

"We're starting to see the end of the World War II and Korea generations, and seeing more and more referrals from the Vietnam era. I anticipate we'll be seeing more clients from the current wars. We're currently retooling how we serve those populations, because they're vastly different. They're not going to just want to sit around and play Bingo," he said. "They'll have higher expectations in terms of the care provided and what options are available to them."

BIG SPRING — U.S. Rep. Randy Neugebauer enjoyed two things about Thursday's lunch at the Texas State Veterans Home — chatting with some "real American heroes" and eating real West Texas barbecue.

"In Washington, I don't know what it is they call barbecue, but it's nothing like the real thing," he told his tablemates. "Whenever I come back home, I always try to get my fill of brisket."

Neugebauer, R-Lubbock, was here to visit two veterans facilities along with U.S. Reps. Mike Conaway, R-Midland, and Jeff Miller, R-Florida, chairman of the House Veterans Affairs Committee.

The morning was spent at the VA Medical Center, but at noon, Neugebauer headed to the Lamun-Lusk-Sanchez Texas State Veterans Home.

Following a brief meeting with the state home leadership, Neugebauer and his staff took their place in line behind about 30 veterans. About 150 men and women currently live at the home.

After loading up his plate with brisket, beans and potatoes, Neugebauer took a seat at a table with three veterans.

Conversation topics ranged from barbecue to budget cuts.

Neugebauer said he agreed with comments Miller made earlier at the VA Medical Center that veterans programs should be taken off the table as much as possible when Congress considers funding cuts. The VA is the second-largest department within the federal government, with more than 300,000 employees and an annual budget of nearly $100 billion. Only the Department of Defense is larger.

"I think what the chairman said is right: to the greatest extent possible, we're trying to preserve that funding," Neugebauer said.

"It's not just how much money you spend, many times it's how you spend it. What we want to do is take advantage of technology and new techniques. We want to make sure we have good, relevant, available health care for our veterans. We may deliver it in different ways, but the bottom line is we make sure we deliver it."

Neugebauer said he also recognized the need to address spending within the agency.

"We owe the American taxpayers the responsibility of delivering (veterans' health care) in a responsible, cost-effective way," he said.

It will be challenging, he said, especially since the current budget calls for "unsustainable" borrowing of 42 cents of every dollar spent.

"Families can't do that, businesses can't do that, and our government cannot continue to do that. What we're going to have to do is prioritize how we spend that money in the future, and certainly our veterans are going to be one of our priorities," he said.

Walter Durham, 83, a World War II veteran, has lived at the veterans home for about a year. He said he draws a little more than $1,200 a month in Social Security and VA benefits, and if cuts were made to the VA budget, he would have significant financial worries.

"If it wasn't for the VA, I couldn't live in this home, afford the medications I need, or get the care I need here. And I got nowhere else to go," he said.

"The government promised us, when we came out of the service, that they'd take care of us when we needed it. Veteran funding should be 100 percent off-limits," he said.

Bob Kerr, administrator of the home, said the funding picture may be cloudy, but the ongoing need for veterans services is clear.

"We're starting to see the end of the World War II and Korea generations, and seeing more and more referrals from the Vietnam era. I anticipate we'll be seeing more clients from the current wars. We're currently retooling how we serve those populations, because they're vastly different. They're not going to just want to sit around and play Bingo," he said. "They'll have higher expectations in terms of the care provided and what options are available to them."

Labels:

Affliate Marketing

Friday, 2 September 2011

Real estate fraudsters get creative

By Veronica Rocha, veronica.rocha@latimes.com

As real estate fraud cases increase throughout region, Glendale police say thieves are becoming more sophisticated in their approach to defrauding the real estate owners.

From falsifying documents to paying off people to use their credit to buy a home, detectives say criminals will do just about anything during the recession to make money — even if it means selling a sibling’s home without their knowledge.

Gregor Tevan was sentenced on Aug. 9 to two years in prison for doing just that to his brother, according to police.

Tevan’s brother, who declined to use his name, said he didn’t know that his rental property on Allen Avenue, where their mother lived, had been sold until Tevan confessed to another sibling about what he had done.

“I was just shocked on how easy it is to manipulate the system,” he said.

Tevan, who was a real estate agent, concocted a scheme to sell his brother’s property to pay off his gambling debts, police said.

Since Tevan helped his brother acquire three properties, he kept a record of all housing documents, his brother said.

Glendale Police Det. Daniel Suttles said Tevan forged documents by cutting and pasting critical information and using a notarized stamp to make it appear that he was the true owner of the Allen Avenue home.

Tevan sold the property for $50,000 to a buyer who he said obtained a title insurance policy. The buyer believed he could sell it to make a profit, Suttles said.

While the buyer didn’t lose any money, and while Tevan’s brother eventually regained title to the property, the title company, First American Bank, did lose money.

Tevan’s brothers notified police about the fraud after he fled the country to live with another brother in Australia, Suttles said.

Meanwhile, detectives continued to investigate the case.

Investigators typically take up to 18 months to build a real estate fraud case. They use the time to request, and then go through, hundreds of documents, Suttles said.

“[Real estate fraud] is not made to make sense,” he said.

When Tevan returned to the U.S. in August 2009, he was arrested and charged in the fraud.

He pleaded no contest last August to two felony counts of forgery, said Jane Robison, spokeswoman for the Los Angeles County district attorney’s office.

He was given a year to pay restitution, but did not do so, according to Suttles.

Los Angeles County Superior Judge Janice Croft sentenced Tevan to serve time behind bars and ordered him to pay $47,500 to the title company, Robison said.

The experience has opened Tevan’s brother’s eyes to the world of real estate fraud. He said he now frequently checks property records.

“I hope no one goes through it,” he said. “He broke down a whole family.”

As real estate fraud cases increase throughout region, Glendale police say thieves are becoming more sophisticated in their approach to defrauding the real estate owners.

From falsifying documents to paying off people to use their credit to buy a home, detectives say criminals will do just about anything during the recession to make money — even if it means selling a sibling’s home without their knowledge.

Gregor Tevan was sentenced on Aug. 9 to two years in prison for doing just that to his brother, according to police.

Tevan’s brother, who declined to use his name, said he didn’t know that his rental property on Allen Avenue, where their mother lived, had been sold until Tevan confessed to another sibling about what he had done.

“I was just shocked on how easy it is to manipulate the system,” he said.

Tevan, who was a real estate agent, concocted a scheme to sell his brother’s property to pay off his gambling debts, police said.

Since Tevan helped his brother acquire three properties, he kept a record of all housing documents, his brother said.

Glendale Police Det. Daniel Suttles said Tevan forged documents by cutting and pasting critical information and using a notarized stamp to make it appear that he was the true owner of the Allen Avenue home.

Tevan sold the property for $50,000 to a buyer who he said obtained a title insurance policy. The buyer believed he could sell it to make a profit, Suttles said.

While the buyer didn’t lose any money, and while Tevan’s brother eventually regained title to the property, the title company, First American Bank, did lose money.

Tevan’s brothers notified police about the fraud after he fled the country to live with another brother in Australia, Suttles said.

Meanwhile, detectives continued to investigate the case.

Investigators typically take up to 18 months to build a real estate fraud case. They use the time to request, and then go through, hundreds of documents, Suttles said.

“[Real estate fraud] is not made to make sense,” he said.

When Tevan returned to the U.S. in August 2009, he was arrested and charged in the fraud.

He pleaded no contest last August to two felony counts of forgery, said Jane Robison, spokeswoman for the Los Angeles County district attorney’s office.

He was given a year to pay restitution, but did not do so, according to Suttles.

Los Angeles County Superior Judge Janice Croft sentenced Tevan to serve time behind bars and ordered him to pay $47,500 to the title company, Robison said.

The experience has opened Tevan’s brother’s eyes to the world of real estate fraud. He said he now frequently checks property records.

“I hope no one goes through it,” he said. “He broke down a whole family.”

Labels:

Affliate Marketing

Home Video - Subscription Movie Scheme In New Test

Subscription Movie Scheme In New Test

MoviePass, the company that wants to be to theaters what Netflix is to home video, is back in business again. The company had planned to launch a test of its subscription-based ticketing service in San Francisco last June, and it reportedly signed up about 30,000 people willing to pay $50 a month to watch an unlimited number of movies in theaters. All it needed was the co-operation of the city's theater chains -- and that was not forthcoming. MoviePass co-founder Stacy Spikes told today's (Thursday) San Francisco Chronicle that the action of the chains "caught everyone off guard." Now, MoviePass has a new partner, Hollywood Movie Money, a company that has been handling discount vouchers for movie theaters for 25 years. The plan is to allow MoviePass subscribers to print out Hollywood Movie Money vouchers on their computers and bring them to the theater. The announcement of the deal between MoviePass and Hollywood Movie Money failed to spell out an important detail If most of the subscribers are frequent moviegoers, how will the partnered companies make money? Source http://www.contactmusic.com/

Labels:

Affliate Marketing

Your Stars - Sept. 2

CELEBRITIES BORN ON THIS DAY: Salma Hayek, 45; Keanu Reeves, 47; Mark Harmon, 60; Terry Bradshaw, 63.

Happy Birthday: Travel, socializing and making your home the perfect spot for you should be high on your list of things to do. You can make money through worthwhile investments or selling off possessions, as well as through offering your skills at a price. Helping others will lead to greater involvement with people who share your vision or need your help. Love is in the stars, and discussing your personal plans will pay off. Your numbers are 9, 14, 20, 33, 36, 38, 47.

ARIES (March 21-April 19): Don't limit the possibilities. If someone pressures you, be prepared to reciprocate. Concentrate on honing your skills and using what you have to offer in a unique manner. There is no time to bicker over something you cannot change. 3 stars

TAURUS (April 20-May 20): A partnership will open doors to bigger and better opportunities. Love is in the stars, and planning something special will enhance your current relationship or, if single, lead to an interesting encounter. 3 stars

GEMINI (May 21-June 20): Do your best to take care of any pressing matters at home before you go out with friends or get involved in social events. Avoid emotional discussions. A personal problem will develop if you are flirtatious. 3 stars

CANCER (June 21-July 22): Interact with friends, neighbors and relatives. You should enjoy getting involved in a hobby or interest that makes you feel like you are accomplishing something. Shopping for bargains should be scheduled. Love is in the stars. 5 stars

LEO (July 23-Aug. 22): Do your best to finish what you start, especially if it has to do with a promise you made to someone special. You can change your home or plan to visit a place you've never been before. The change will do you good. 2 stars

VIRGO (Aug. 23-Sept. 22): You'll have a clear-cut vision regarding how you can help friends, family or someone in need. Your kindness will impress the people you encounter throughout the day. Visit familiar places or touch base with someone from your past with whom you would like to reconnect. 4 stars

LIBRA (Sept. 23-Oct. 22): You have to pay more attention to how you can work toward greater financial freedom. Use your insight and creative ideas to come up with a prosperous venture. Using emotional tactics, you will have no trouble persuading the right people to support your plans. 3 stars

SCORPIO (Oct. 23-Nov. 21): It's time to have a little fun. Whether you are single or in a relationship, it's important to interact with people who interest you. Much can be accomplished if you are upfront about your feelings and intentions. 3 stars

SAGITTARIUS (Nov. 22-Dec. 21): Accept the inevitable and keep on moving. Not everyone will agree with what you are doing or planning, but as long as you don't mislead anyone, you should be able to make the changes required to reach your goals. 3 stars

CAPRICORN (Dec. 22-Jan. 19): Added responsibilities may be a burden, but if you do what's being asked, it will become clear that good results will materialize. Changes at home will pay off and bring you greater respect, coupled with a promise from someone who is important to you. 4 stars

AQUARIUS (Jan. 20-Feb. 18): Don't let emotional matters escalate. You have to stay in control and call the shots. Listen and observe, and it will help you avoid trouble and make a wise choice. 2 stars

PISCES (Feb. 19-March 20): Touch base with yesteryear. People, places and old ideas will surface, allowing you to revisit some goals that got left by the wayside. Don't be afraid to contact someone from your past who can help you with a goal you want to pursue. 5 stars

Birthday Baby: You are intense, persistent, detail-oriented, creative and worldly.

COPYRIGHT 2011 UNIVERSAL UCLICK

Source http://www.theday.com/

Happy Birthday: Travel, socializing and making your home the perfect spot for you should be high on your list of things to do. You can make money through worthwhile investments or selling off possessions, as well as through offering your skills at a price. Helping others will lead to greater involvement with people who share your vision or need your help. Love is in the stars, and discussing your personal plans will pay off. Your numbers are 9, 14, 20, 33, 36, 38, 47.

ARIES (March 21-April 19): Don't limit the possibilities. If someone pressures you, be prepared to reciprocate. Concentrate on honing your skills and using what you have to offer in a unique manner. There is no time to bicker over something you cannot change. 3 stars

TAURUS (April 20-May 20): A partnership will open doors to bigger and better opportunities. Love is in the stars, and planning something special will enhance your current relationship or, if single, lead to an interesting encounter. 3 stars

GEMINI (May 21-June 20): Do your best to take care of any pressing matters at home before you go out with friends or get involved in social events. Avoid emotional discussions. A personal problem will develop if you are flirtatious. 3 stars

CANCER (June 21-July 22): Interact with friends, neighbors and relatives. You should enjoy getting involved in a hobby or interest that makes you feel like you are accomplishing something. Shopping for bargains should be scheduled. Love is in the stars. 5 stars

LEO (July 23-Aug. 22): Do your best to finish what you start, especially if it has to do with a promise you made to someone special. You can change your home or plan to visit a place you've never been before. The change will do you good. 2 stars

VIRGO (Aug. 23-Sept. 22): You'll have a clear-cut vision regarding how you can help friends, family or someone in need. Your kindness will impress the people you encounter throughout the day. Visit familiar places or touch base with someone from your past with whom you would like to reconnect. 4 stars

LIBRA (Sept. 23-Oct. 22): You have to pay more attention to how you can work toward greater financial freedom. Use your insight and creative ideas to come up with a prosperous venture. Using emotional tactics, you will have no trouble persuading the right people to support your plans. 3 stars

SCORPIO (Oct. 23-Nov. 21): It's time to have a little fun. Whether you are single or in a relationship, it's important to interact with people who interest you. Much can be accomplished if you are upfront about your feelings and intentions. 3 stars

SAGITTARIUS (Nov. 22-Dec. 21): Accept the inevitable and keep on moving. Not everyone will agree with what you are doing or planning, but as long as you don't mislead anyone, you should be able to make the changes required to reach your goals. 3 stars

CAPRICORN (Dec. 22-Jan. 19): Added responsibilities may be a burden, but if you do what's being asked, it will become clear that good results will materialize. Changes at home will pay off and bring you greater respect, coupled with a promise from someone who is important to you. 4 stars

AQUARIUS (Jan. 20-Feb. 18): Don't let emotional matters escalate. You have to stay in control and call the shots. Listen and observe, and it will help you avoid trouble and make a wise choice. 2 stars

PISCES (Feb. 19-March 20): Touch base with yesteryear. People, places and old ideas will surface, allowing you to revisit some goals that got left by the wayside. Don't be afraid to contact someone from your past who can help you with a goal you want to pursue. 5 stars